Bitcoin (BTC) is showing conflicting signs in long and short-term time frames, making the direction of the trend unclear.

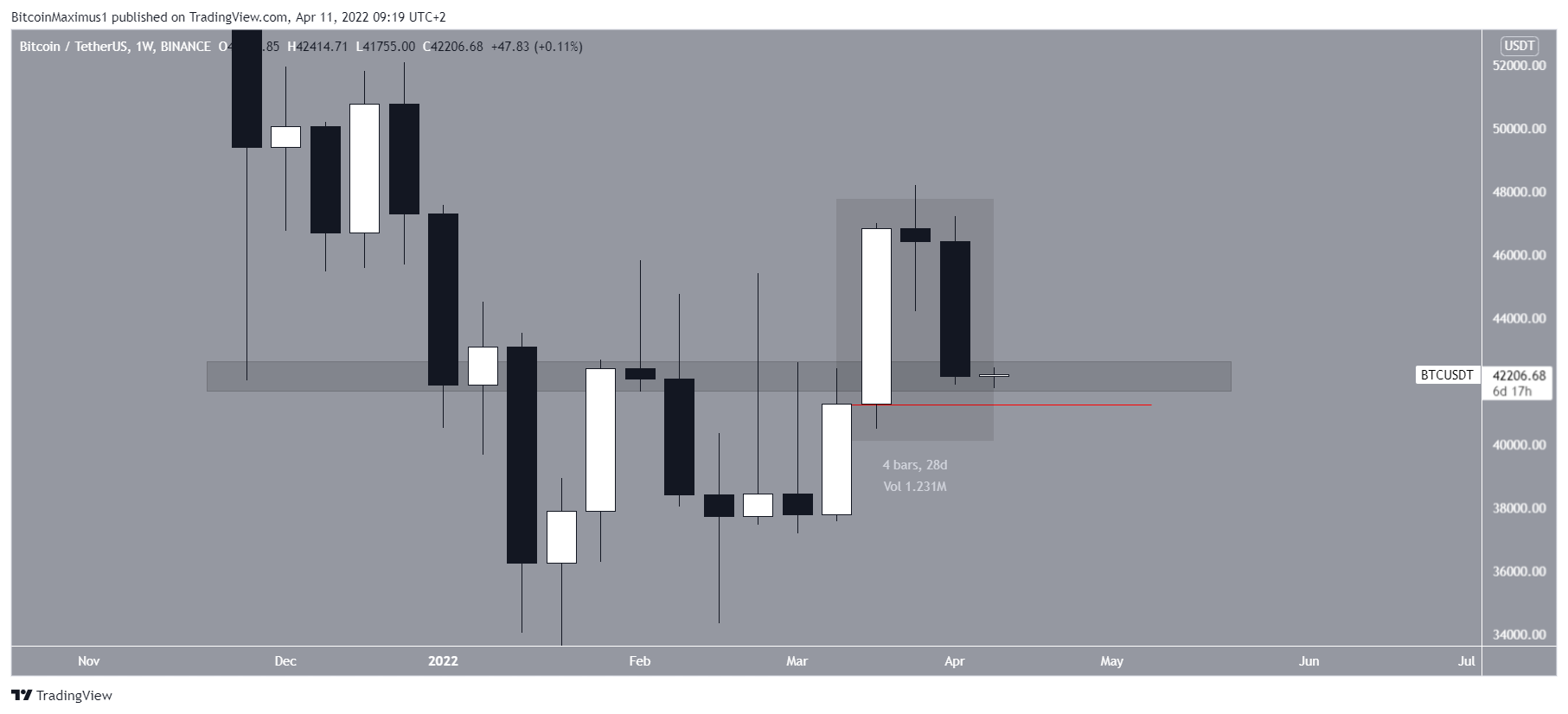

Bitcoin decreased considerably during the week of April 4-11, creating a bearish candlestick in the process. The price fell from a high of $47,200 to a low of $41,868.

Despite the drop, the price has managed to hold on above the $42,000 area, which has intermittently acted as both support and resistance since November 2021.

In addition to this, the MACD is still bullish, since it has created the fourth successive bullish candlestick in a row (green icon).

Therefore, as long as BTC does not reach a close below the $42,000 area, it’s still possible that the decrease is simply a retest of the previous breakout level.

Measuring from the all-time high, the price thus far decreased by 39%.

It’s worth noting that the three most recent weekly candlesticks are close to creating an evening star pattern, which is often considered a bearish reversal candlestick pattern. The fact that this pattern could transpire in the weekly time frame increases its significance.

The evening star would be confirmed with a weekly close below $41,262 (red line).

Daily time frame breakdown

The daily chart provides a more bearish outlook.

The price has fallen below the $45,000 horizontal area, a level that acted as resistance from Feb 8 until the March 7 breakout. However, since BTC broke down below it on April 7, the previous breakout is considered to be just a deviation.

The daily MACD has also been falling for 11 days and is nearly negative (red icon). This is a sign associated with bearish trends, especially if the indicator manages to cross into negative territory.

Over the past 70 days (highlighted), the RSI has moved freely above and below the 50-line. This is considered a sign of neutral trends. Thus, the RSI movement has not been a good predictor of the direction of the trend.

While BTC has been following an ascending support line since January, its slope is not clear due to the presence of long lower wicks.

If the candlesticks are used (dashed), the support line would intersect near $40,000. If the absolute bottoms are used instead, the support line would be found closer to $37,000.

Short-term BTC movement

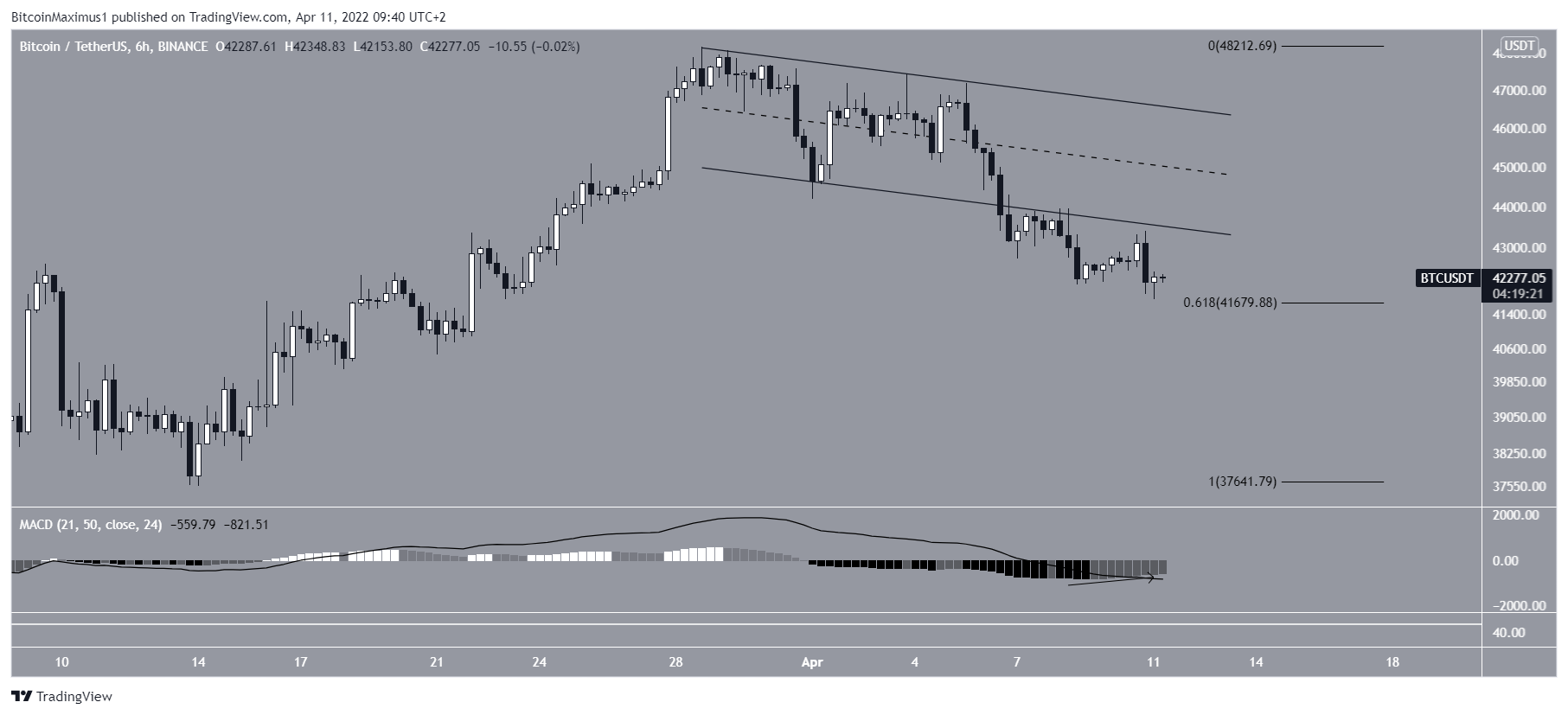

The six-hour chart shows that BTC broke down from a descending parallel channel on April 6 and validated the channel as resistance after.

The price then proceeded to reach a local low of $41,755 on April 11 before bouncing.

When measuring the most recent portion of the upward move, BTC has bounced at the 0.618 Fib retracement support level. The MACD is showing some slight bullish signs (black arrow) but not enough to confirm a reversal.

The two-hour chart also suggests that a rebound in price will transpire. The reason for this is the extremely pronounced bullish divergence that has developed in the RSI.

If a bounce occurs, the support line of the channel at $43,000 would be expected to provide resistance once again.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.