For the last few weeks, the BTC/USD pair has been quite volatile. The recent recovery rallied to the $45000 mark and registered a 38% gain from the $33177 low. However, the Bitcoin (BTC) price turned down from the overhead resistance, indicating the bears are aggressive at this level. The coin price could sink to $40000 support to test the buyers’ commitment.

Bitcoin (BTC) On-chain Data Struggles To Maintain A Bullish Outlook

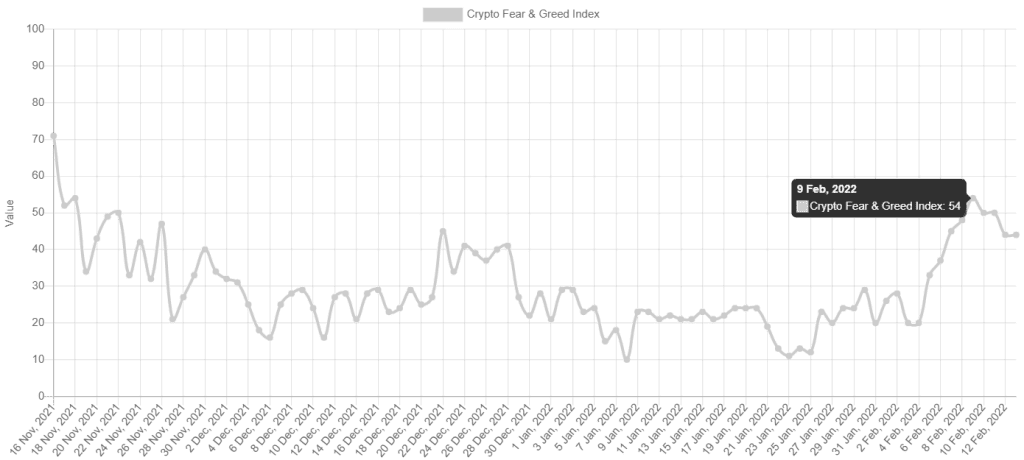

- On February 9th, the Crypto Fear & Greed Index reached the neutral level of 54, which last recorded this high on November 2021. However, due to the recent pullback, the metric has fallen back to fear(44) territory.

- Similar to the above scenario, which was recently highlighted by @SwellCycle, the 7-day Moving average STH-SOPR indicator(which represents the degree of realized profit and loss for all coins moved on-chain for Short-term holders. i.e., with a holding lifespan of fewer than 155 days.) surged above the 1 mark.

- However, the slope couldn’t sustain much longer and slid below 1 support, indicating a clear bullish sentiment has yet been achieved.

Bitcoin (BTC) Price Technical Analysis

Source-Tradingview

On February 4th, the BTC price made a decisive breakout from a confluence of technical levels, i.e., $40000 psychological level, descending trendline, and 20-day EMA. The sustained buying surged the coin price by 13%, bringing it to $45000.

However, the bears continued to defend this resistance, resulting in a minor pullback in price action. The BTC price currently trades at $42564, indicating a 7.2% loss from the overhead resistance. The falling coin price approaches the shared support of $40000 and 20 EMA.

A rebound from this crucial support level would indicate bulls are buying this dip and would give another attempt to push the BTC/USDT pair above $45,000. On a contrary note, if sellers pulled the price below the $40000 mark, the coin price would plunge to $36,721 or $33177.

- Resistance level- $45000, $52000

- Support level- $40000, $36721

Bitcoin price indicators

A recent price jump has turned the dynamic resistance of the 20-day EMA into potential support. Buyers will likely encounter the trend defining 200 EMA near the $45000 mark, which stands as a key barrier to bolster BTC recovery.

Moreover, the RSI(55) slope holding above the 14-SMA and the neutral line suggests the buyers have an upper hand.