Bitcoin’s meteoric rally liquidated about $172 million in short positions in the last 24 hours, data from coinglass.com shows. The currency led a crypto market recovery from one-month lows as U.S. President Joe Biden held off on completely blocking Russia from the global financial system.

Bitcoin price jumps 10% in last 24 hrs

The world’s largest cryptocurrency jumped 10% in the last 24 hours, coming close to $40,000 after concerns over Russia’s invasion of Ukraine knocked it below key support levels. Most altcoins logged double-digit gains.

The growth dynamics were relatively modest, which indicates the caution of buyers. It is likely that these are long-term holders rather than short-term speculators, as markets generally remain wary.

-Alex Kuptsikevich, a senior financial analyst at FxPro.

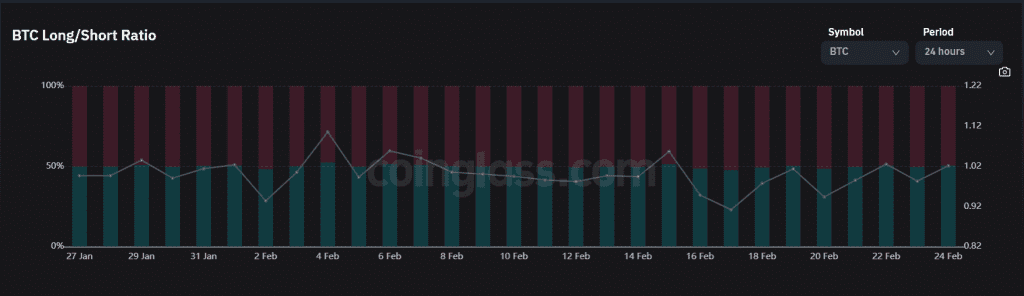

Data showed overall positioning on BTC was largely short this month.

OKX had the highest ratio of short positions, at about 90% with $35 million worth of shorts. Binance had the second-highest number of shorts, while 59% of positions on FTX were long over the past 24 hours.

The single largest liquidation order happened on Bitmex, and was worth nearly $8 million. Overall, traders who were short against the crypto market lost a whopping $402 million over the past 24 hours.

The move harkens back to the GameStop short squeeze last year, where increased retail and social media interest drove the company’s highly-shorted share price from single digits to nearly $500 in a few days. The spike had cost short positions on the stock as much as $20 billion.

Cryptocurrencies had tracked a broader rally in financial markets. U.S. stocks had surged more than 1% on hopes that the latest bout of U.S. sanctions would not be as economically damaging as feared.

But in crypto, safe-haven trades still dominated volumes. Stablecoin Tether accounted for more than half of the market’s volumes in the last 24 hours, at nearly $63 billion- more than those of Bitcoin and Ethereum combined.