The Bitcoin (BTC) long-term total cost base has fallen to an all-time low, as per the on-chain data firm Glassnode. Moreover, Bitcoin is undergoing a very healthy redistribution of supply since the price fell from its highs. This week, the bitcoin price has broken its consolidation zone to rise higher above $48,000k.

Bitcoin Undergoing Healthy Redistribution

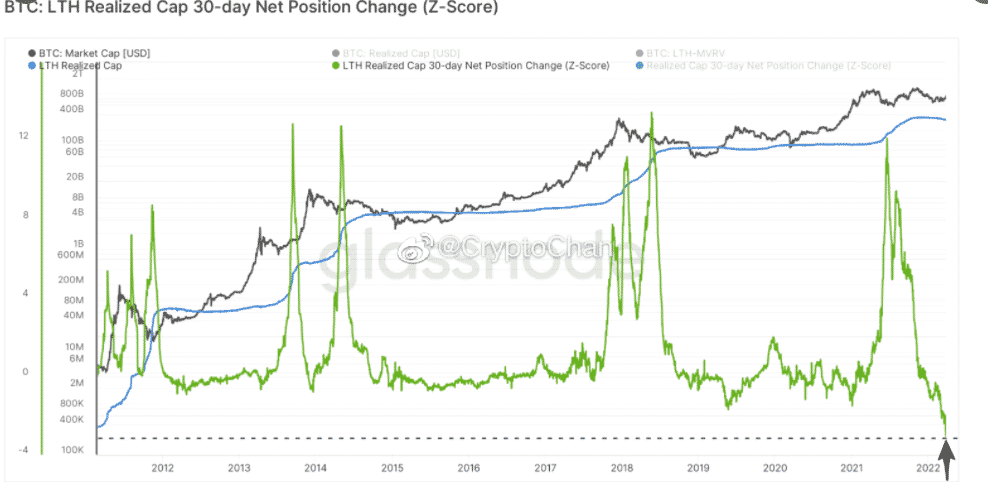

According to on-chain data from Glassnode, the LTH Realized Cap 30-day Net Position Change Z-Score has hit a historically low. It suggests that long-term holders of Bitcoin cost basis have declined significantly. Moreover, a very healthy redistribution of Bitcoin supply from higher prices is taking place. And, the new floor range is between $38k and $45k.

Under the consolidation zone between $35k-$45k, Bitcoin has seen a heavy reshuffling of its supply. There is a decrease in long-term holders and an increase in short-term holders. Thus, giving the opportunity to Bitcoin holders to increase accumulation as the price could rally from here.

Bitcoin price has pushed beyond the resistant levels as a result of the accumulation of Bitcoin by the LUNA Foundation Guard for its stablecoin UST, Russia considering accepting Bitcoin for oil and gas payments, and ExxonMobil plans to mine bitcoin with natural gas.

Moreover, whales and crypto influencers such as Michael Saylor and Elon Musk are accumulating Bitcoin (BTC) for inflation hedge and store of value amid the rising inflation and oil prices.

The Rise in Bitcoin Price Amid Growing Adoption

Bitcoin adoption has grown significantly in recent years as people realize its benefits. According to CoinMarketCap, the price of Bitcoin rose nearly 12% in the week, with the current price trading near $47,076. At the time of writing, the current market cap is around $899 billion.

In the last 24 hours, the Bitcoin price is down 1.51% from the recent high of $48,086. However, as per the on-chain data, the price will increase to move higher towards $50,000, the next psychological level.