Bitcoin (BTC) price falls mercilessly for the second day in a row on Thursday. BTC trades near the critical $35,000 level in tandem with the stock markets in the U.S. In the past 24-hour the total market capitalization of the cryptocurrency market has fallen nearly 5%.

- Bitcoin (BTC) sinks below $35k on Thursday.

- Global risk aversion amid Russia’s invasion of Ukraine has shaken the markets.

- Investors bet on breaking of January lows of $32,933.33.

At the time of writing, BTC/USD is trading at $35,229.01, down 5.49% for the day. The world’s largest and most populous cryptocurrency by market cap held 24-hour trading volume at $36,562,674,794 rising almost 52%.

BTC price is on the verge to collapse toward $29k

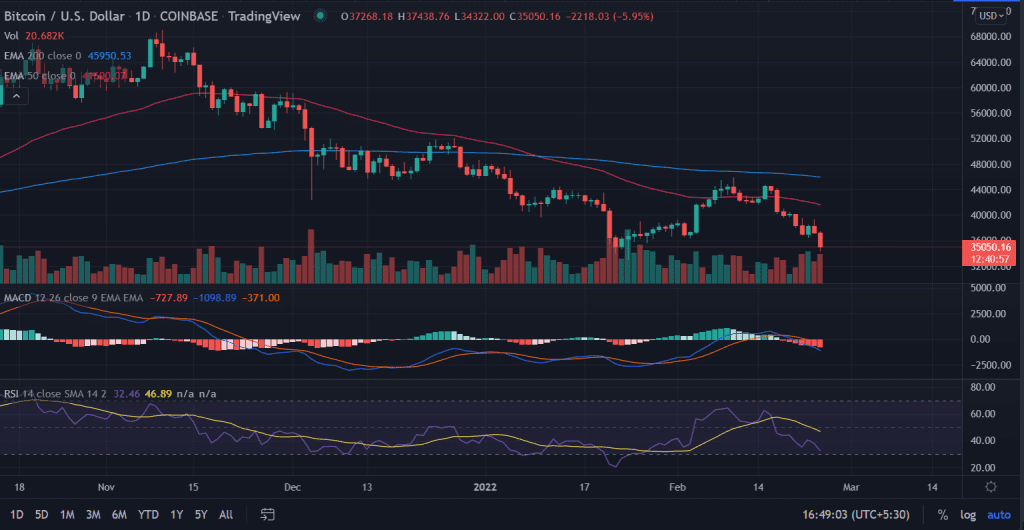

On the daily chart, Bitcoin (BTC) remained under pressure near $45K as it happens to be a crucial support-turn-resistance level. Thus, a failure to break away from this milestone after the recent consolidation of price in late January plays a significant role in deciding the next future course of action.

The price rallied nearly 45 from the lows of $32,933.33 made on January 22. Further, after making a swing high at $45,855 BTC meets the demand zone extended from $32,000 to $35,000 once again.

Now, if the selling pressure intensified then there is no price for guessing the next level for BTC could be found $32,000.

A retest of $32k would make investors skeptical about the recovery chances in BTC, in fact, a weekly close below the mentioned level would seek depreciation toward $29k.

On the flip side, a quick reversal from the current level might bounce back to $40,000. Moreover, a decisive close above 50-day EMA at $41,597 will pave a way for $44,000 next.

Technical Indicators:

RSI: The Daily Relative Strength Index (RSI) approaches toward the oversold zone with current reading of 29.

MACD: The Moving Average Convergence Divergence (MACD) trades below the midline with significant bearish momentum.