Bitcoin’s (BTC) price is retracing to $21,000 after the massive sell-off negates the uptrend, as predicted in the previous report. The BTC price is now trading below the 200-weekly moving average (WMA) after falling nearly 9% to below $22,000 in the last 24 hours.

Bitcoin (BTC) Price Risks Falling to $20,000-$21,000 Range

Bitcoin (BTC) price rally comes to an end after the price entered a short-term overvalued region this week. The BTC price retraced from the short-term resistance level after making a high of $25,135. Whales and long-term holder had sold their holdings after a pullback to the $23k-$24k range.

The Crypto Market Fear and Greed Index tumbles from 47 to 30 in a week as market sentiments turn negative. Moreover, the Federal Reserve confirming aggressive interest rate hikes in the coming months, massive sell-off pressure, and exchange inflows are causing the Bitcoin (BTC) price to break lower.

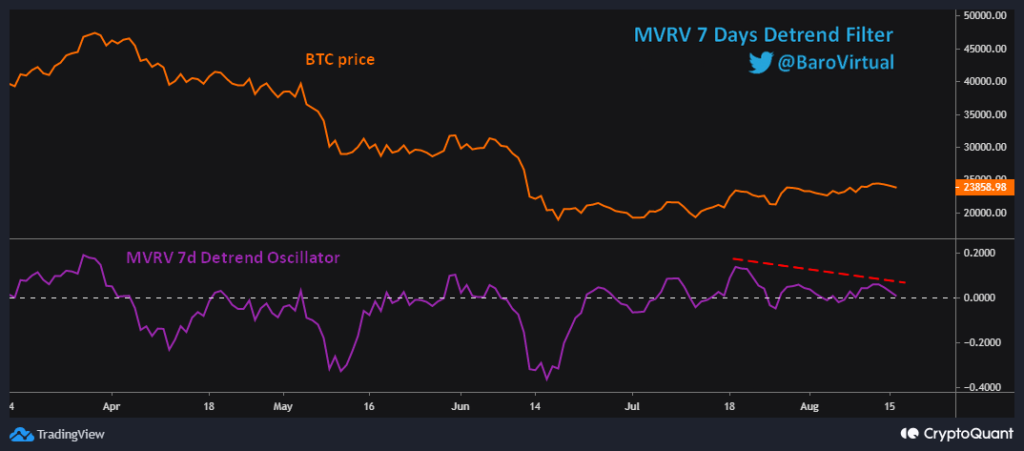

As reported earlier, the Bitcoin price trend has formed a bearish divergence pattern in the MVRV 7-day Detrend Oscillator. A bearish divergence pattern predicts an upcoming price fall. It suggests the Bitcoin (BTC) price risks falling to the $21,000-$20,000 range.

Bitcoin (BTC) bulls have faded as the recent sell-off has pulled the Bitcoin price in favor of bears. The Bitcoin (BTC) price is now trading below $23,000, the key 200-weekly moving average (WMA). Thus, a fall below $21,000 seems imminent.

Trending Stories

Moreover, the 20-EMA (red) did move above the 50-EMA (blue), generally considered a bullish trend. However, the bulls failed to build momentum, the 20-EMA moves below the 50-EMA again, confirming a bearish movement below $21,000.

As per Coinglass data, Bitcoin price recorded a total liquidation of over $168 million in the last 24 hours, with $150 million liquidation coming from long-term positions. Major exchanges including Huobi, Binance, and Okex accounted for over 90% of long positions liquidated in the last 24 hours.

Here’s What Popular Crypto Analysts Expect

Crypto analysts including Michaël van de Poppe, Crypto Tony, Crypto Birb, and BigCheds earlier confined a fall below the $22,700 level. Crypto analysts believe the 200-WMA will play a key role here.

Most analysts are positive about an upside move from lower levels. The Bitcoin price fall has given a “buy-the-dip” opportunity for investors as the short-term resistance is at the $25,000 level.

- Crypto Market Plummets, Will The Hawkish Fed Create New Lows

- CBDC Wars: This African Country Has Close to 1 Million CBDC Users

- Bitcoin (BTC) Price Retracing To $21,000, This Remains Key Resistance Level

- Bitcoin (BTC) Tanks Another 3%, Here’s The Key Metric to Focus

- Largest ETH Mining Pool Will Not Support Ethereum PoW

- Breaking: Bitcoin (BTC) Price Risks Falling Below $21,000, Here’s Why

- Ripple CTO Fires Back At Vitalik’s “China-controlled” Comment

- Canada Restricts Crypto, Here’s How The New Rules Affect You

- Just-In: Socios Gains Regulatory Approval In Key Market, Chiliz (CHZ) Price Jumps

- BTC, ETH, DOGE: Why Major Cryptos Are Trading In Red Today?