Bitcoin bulls have failed to gain control of the rally and pushed BTC into the hand of bears. The BTC price continues to dive below the $20,000 level amid the selling pressure and bearish sentiment. In fact, the Bitcoin (BTC) price will most likely enter a period of inactivity in September.

Bitcoin (BTC) Enters Its Historically Bad Month

September has been historically a bad month for Bitcoin since 2017. The BTC price on average had dropped 8.5% in September in the last 5 years. However, crypto analysts believe this year is different as fundamentals and on-chain activity improved amid adoption due to price drop.

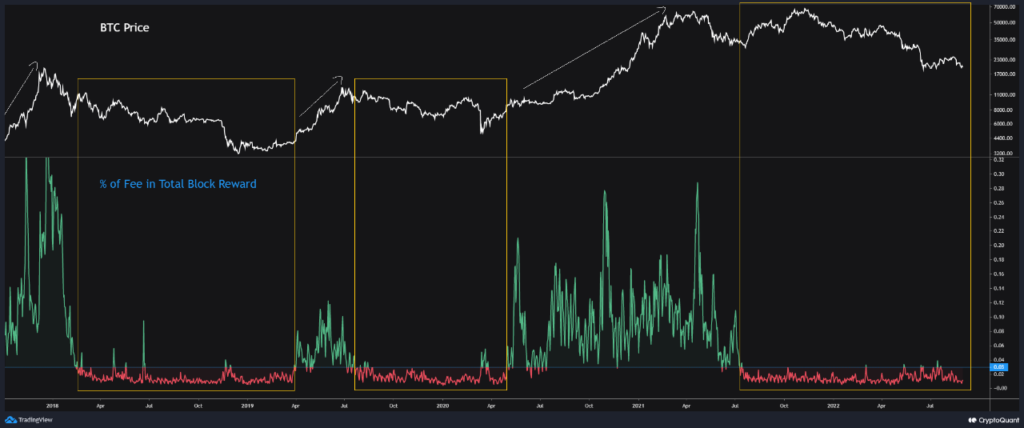

Bitcoin (BTC) price dropped below $21,000 due to a market-wide sell-off, as predicted in a previous report. The Bitcoin price is in a long period of inactivity. The Bitcoin network demand is low as the percentage of fees in total block reward is low.

Historically, every time the percentage of fees in the block reward drops below 3%, the BTC is oversold and bearish. As the metric jumps above 3%, the bearish cycle usually ends.

Traders should wait until the percentage of fees in the total block reward jumps over 3%. It will indicate increasing demand in the network, suggesting potential market strength.

Trending Stories

The new bull cycle is still far as the network demand is still low. Thus, investors should wait for a bear rally to give a clear bullish signal.

Moreover, the hawkish stance of Fed Chair Jerome Powell and sell-offs by dormant whale accounts show chances of further slip in Bitcoin (BTC) price.

Here’s What Crypto Analysts Say About Bitcoin (BTC) Price

Crypto analyst Michaël van de Poppe thinks the Bitcoin (BTC) price can still go lower at $19.9k. “A sweep of $19.5K is on the cards.” Moreover, he prefers a break of $20.6k at lower timeframes to conclude a bullish continuation.

According to Crypto Birb, the crypto market is weak and stagnant as most cryptocurrencies are below 20-day SMA. Breaking above the 200-WMA at $23k is crucial for Bitcoin.

As per Crypto Tony, “September is historically a bearish month.” There will be fake-outs, volatility, and inactivity.