Bitcoin (BTC) created a bullish candlestick on Feb 23 and is now approaching a make-or-break resistance level.

BTC increased considerably on Feb 23, bouncing at the $36,600 horizontal support area (green icon). The area has acted as support since the upward movement began on Jan 24.

However, the price barely failed to create a bullish engulfing candlestick, since the closing price close was only slightly lower than the preceding open.

The next macro resistance is found at $44,200.

Ongoing BTC bounce

The six-hour chart shows that the main resistance area is located at $40,050, created by the 0.382 Fib retracement resistance level.

In addition to this, the resistance corresponds with the midline of a descending parallel channel, from which BTC broke down on Feb 15.

This possibility is further supported by the two-hour chart, which shows that BTC broke out from a descending resistance line after generating a significant bullish divergence.

As a result, an upward move towards $40,050 seems to be the most likely scenario.

Wave count analysis

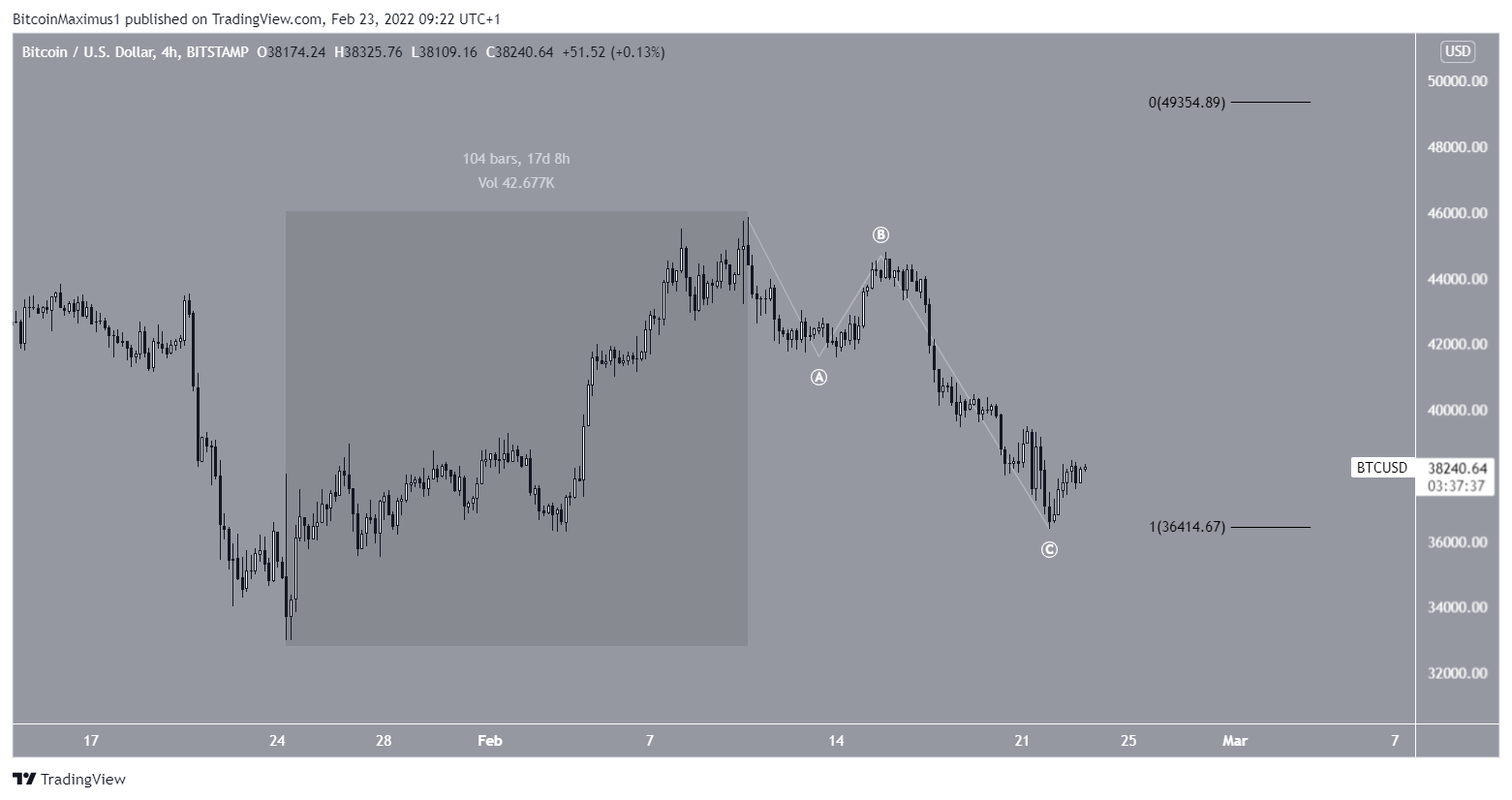

There are two likely possibilities for the long-term Bitcoin count.

Similarly, there are two main possibilities for the short-term count. Whichever transpires will also likely determine the long-term trend.

The first scenario suggests that BTC has completed an A-B-C corrective structure.

Therefore, an upward movement towards $49,350 would be expected. This target is found by projecting the height of the previous increase.

The second scenario suggests that the ongoing decrease is part of a bearish impulse. In this case, the price is correcting inside wave four prior to another drop.

Whether or not BTC manages to break above the Feb 14 low at $41,575 (red line) will be crucial in determining which of the counts is most likely to transpire.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.