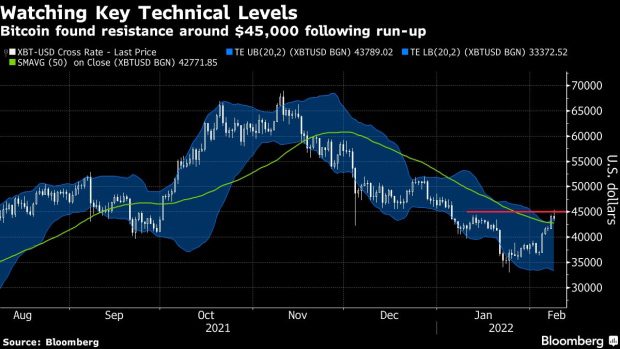

On Tuesday, Feb 8, Bitcoin (BTC) climbed all the way to $45,000 in a continued rally to the north. However, it seems like the world’s largest cry[ptocurrency is witnessing a partial retracement and is currently trading 1.58% down at $43,500 levels.

With the recent price surge, Bitcoin has managed to give a breakout from its falling trendline since November. Matt Maley, chief market strategist at Miller Tabak + Co. told Bloomberg that Bitcoin could be taking a rest for some time after the recent pullback without disturbing much of its last week’s gains. Maley further added:

“Today’s pullback is due to some profit-taking after a big move. Bitcoin had rallied about 38% on an intraday basis in less than two weeks, so I think it’s just a matter of traders taking some short-term profits.”

However, analysts say that we must be careful going ahead this year as they are expecting more volatility in the coming days. The Federal Reserve is set to increase interest rates multiple times this year and this brings more volatility in risky assets like crypto and equity. Brian Nick, chief investment strategist at Nuveen, said:

“There’s not going to be unlimited liquidity from the Fed anymore, and if we have the money-supply contracting, if we have interest rates rising, it will tend to make things like crypto less attractive.”

Bitcoin Mega Whales Continue Accumulation

While Bitcoin was in a downward trajectory throughout the last month of January, mega whales have continued with their accumulation throughout the last month of January. On-chain data provider Santiment reports that this has been the most rapid accumulation in three years since 2019. It adds:

Mega whales of Bitcoin have accumulated significantly the past 7 weeks. Addresses with 1,000 $BTC or more have added a combined 220,000 $BTC to their combined wallets since December 23rd, the most rapid accumulation we’ve seen since September, 2019.

In one of its recent reports, banking giant Well Fargo said that the crypto market is in the early stage of hyper adoption just similar to the internet in the early 90s.