Bitcoin (BTC) has reclaimed a short-term resistance level and is currently in the process of creating a higher low on the daily chart.

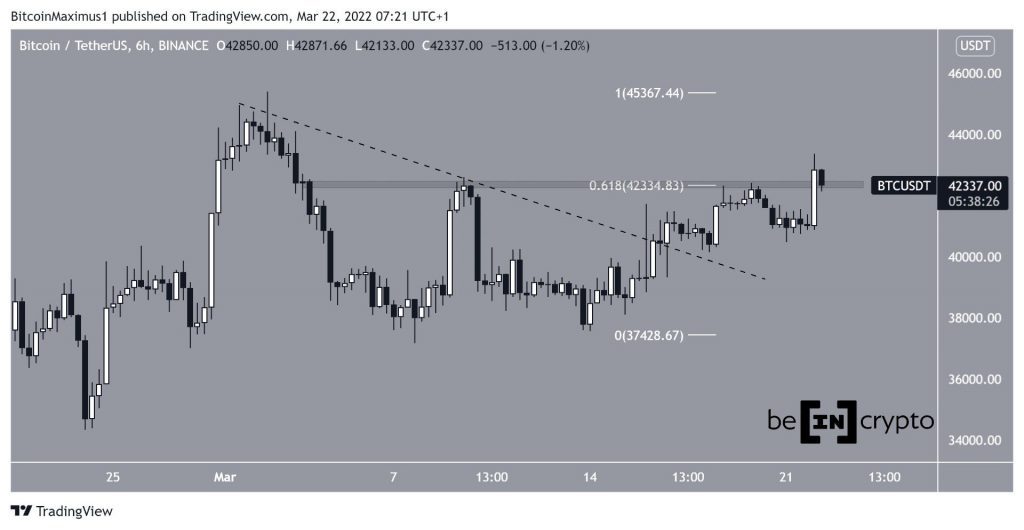

Bitcoin had been decreasing underneath a descending resistance line (dashed) since March 1. On March 15, it managed to break out from the line and continued to move up.

Initially, the price was rejected by the $42,330 resistance. This is the 0.618 Fib retracement resistance level when measuring the most recent drop and also a horizontal resistance area.

However, BTC was successful in moving above the area on March 22 and is currently attempting to validate it as support. If successful, this would be a bullish development because the 0.618 Fib retracement resistance level is often a crucial resistance to overcome after considerable drops.

Long-term support level

The daily chart shows that BTC has been following a longer-term ascending support line since Jan 22. It bounced at the line on March 14 (green icon) to initiate the current upward move.

More importantly, technical indicators are gradually turning bullish as both the MACD and RSI are increasing.

In addition to this, the MACD is nearly positive. This is a sign that is usually associated with bullish trends. Furthermore, the RSI has already moved above 50, another sign of bullish trends.

If BTC manages to break out from the longer-term descending resistance line (dashed), it would likely accelerate very quickly.

BTC wave count analysis

Currently, there are three potential wave counts at play and all suggest that BTC is trading inside a symmetrical triangle.

The most likely count suggests that BTC is in a B wave triangle. After the triangle is complete, a breakout and move towards $50,000 would be expected.

The sub-wave count is shown in white.

The second possibility suggests that BTC has just completed a long-term correction that began in November 2021 and an increase towards a new all-time high would be expected.

While the ratios are suitable, the shape of the triangle is unusual, casting some doubt on this possibility.

The third scenario suggests that BTC is in a fourth wave triangle. Following the completion of this pattern, a breakdown and drop below $30,000 would be expected.

Due to the discrepancy between waves two and four, this seems to be the least likely count.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.