The world’s largest cryptocurrency Bitcoin (BTC) continues to face strong selling pressure amid uncertainties in the global markets. Over the last weekend, the BTC price has slipped under $19,000 with analysts expecting further downside.

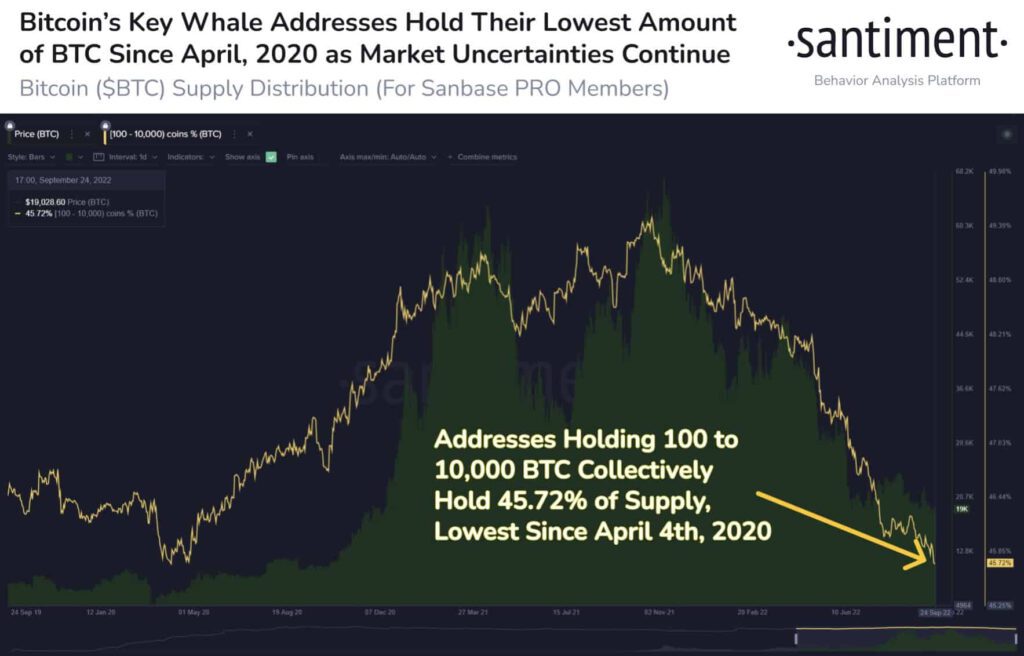

As per the on-chain data, the Bitcoin whale holdings continue to drop for 100 months in a row. As per on-chain data provider Santimenr, amid the fears of inflation and a global recession “addresses holding 100 to 10k $BTC have lowered their percentage of supply held of #crypto‘s top asset to 29-month lows”.

Well, this clearly shows the sentiment that Bitcoin investors remain extremely cautious considering the current macro environment. Also, as per the data on CryptoQuant, the number of short positions in Bitcoin derivatives has been increasing. It noted:

“The BTC holdings on the Derivatives Exchange increased just before dumping BTC. Also, whales seem to have intentionally opened short positions on the Derivatives Exchange and lowered BTC prices.”

Bitcoin Social Dominance Spikes

As we know, along with Bitcoin, the broader crypto market has enetered a severe correction. The altcoin space has witnessed even greater correction in the recent crypto market rout. As a result, the Bitcoin social interest has touched a new 2-month high. As on-chain data provider Santiment reports:

Trending Stories

A spike in #Bitcoin interest on social platforms came this weekend. Among #crypto‘s top 100 assets, $BTC is the topic in 26%+ of discussions for the first time since mid-July. Our backtesting shows 20%+ dedicated to Bitcoin is a positive for the sector.

As Bitcoin clocks its third-consecutive daily loss, the BTC Fear and Greed Index also moves towards “extreme fear” conditions. Earlier today, the Fear & Greed Index fell from 24/100 to 21/100. However, it still continues to hold above 20 levels indicating some investor resilience.

The bears, however, will be eyeing the sub $18,000 levels if the sell-off in the broader market continues.