Bitcoin (BTC) has fallen sharply from its 2022 highs, and is currently languishing in a trading pattern seen for most of the year. But the token’s relatively lower valuation is attracting dip buying by long-term traders with large holdings.

BTC is trading around $40,000, and has fallen over 11% in the past seven days. A mix of inflation jitters, concerns over a possible economic recession and a hawkish Federal Reserve have battered the world’s largest cryptocurrency.

But its latest round of losses have also attracted a slew of dip buyers, who are buying into the currency at relatively lower levels. This could prime BTC for another big rally.

BTC sees continued stream of whale trading

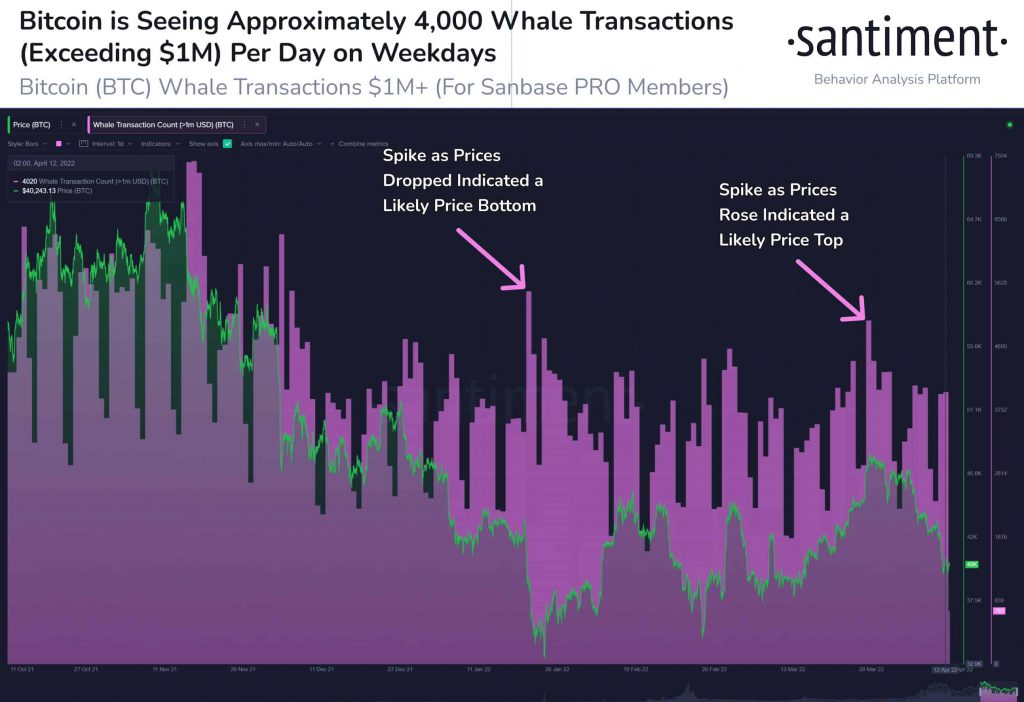

Data from blockchain analytics firm Santiment showed that BTC was seeing a steady number of around 4000 whale transactions above $1 million on weekdays, even as its price retreated. It indicated that large players in the BTC market were still active, even as the token’s price declined.

Historically, a spike in whale transactions has foreshadowed two key events- a price top, and a price bottom. In this case, increased whale activity could indicate that BTC has found a bottom around $40,000, and that the token is poised for more gains. The token has also held around the $40,000 mark over the past two days, lending further credence to the possibility of a recovery.

Large increases are what we are looking out for to foreshadow a price bounce after April’s retrace

-Santiment

Whales in accumulation mode

BTC isn’t the only token seeing increased whale interest due to a price drop. Popular memcoin Shiba Inu (SHIB) saw a staggering amount of whale buying in recent sessions, which helped the token stage a strong recovery.

Proof-of-stake token Cardano (ADA) also saw whale accumulation hit a two-year high, as the token logged sharp losses.

Recent data also suggested that short-term holders were likely behind BTC’s recent price dump. Whales, who usually tend to be long-term holders of the token, were either seen holding onto the token, or buying more of it.