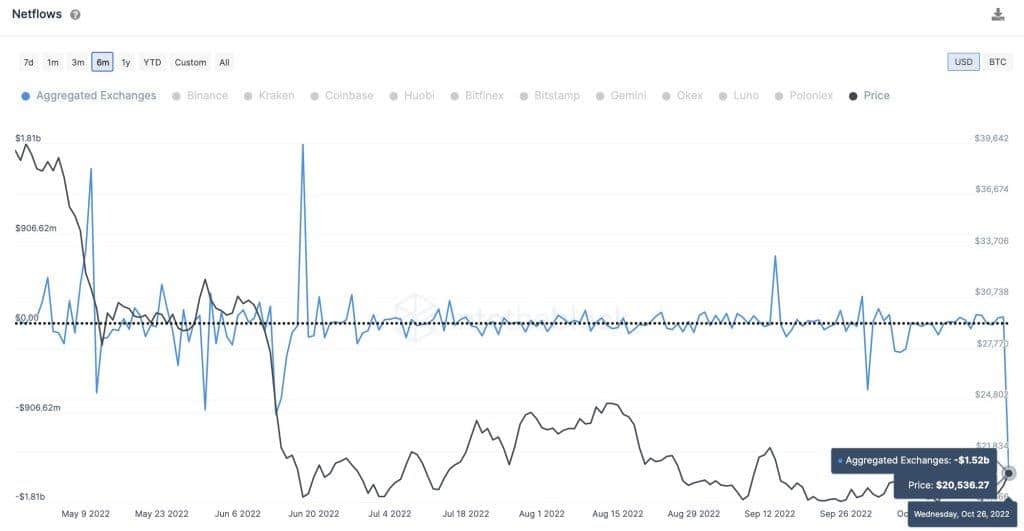

Bitcoin (BTC) price surpassed the 20K level and hit a high of $20.9K, but loses earlier gains due to inflation and recession fears as ECB raises interest rates by 75 bps. However, Bitcoin recorded its largest net outflow from crypto exchanges in the last 6 months, with over 70K BTCs worth $1.52 billion leaving exchanges. BTC price is currently trading at $20,150, down 3% in the last 24 hours.

Bitcoin Records Largest Net Outflow from Crypto Exchanges

According to IntoTheBlock data, Bitcoin price surpassing $20K on Thursday was due to massive outflow recorded from crypto exchanges. Over 70k Bitcoins worth $1.52 billion left exchanges on October 26, the largest net outflow in the last 6 months.

CoinGape earlier reported massive Bitcoin (BTC) movements by whales. In fact, whales moved over 15K bitcoins, which caused the BTC price to surpass $20K.

The latest Santiment data indicates Bitcoin whales are ready to jump back in and push prices to rise higher after a long bear market. The data also reveals that whales and large investors are indeed holding their money in the U.S. and world treasuries.

Large institutional holders and massive whale addresses (blue line) have been dumping their BTC holdings since November last year. The decline in combined USDT and USDC market cap (yellow) depicts large investors and whales moving their money out of stablecoin. Thus, an increase in the market cap of stablecoins will justify a bottom for Bitcoin. However, crypto prices may rise despite the significant increase in whale supply.

Trending Stories

Macroeconomic Factors Affecting Price Rally

While the broader crypto market, including Bitcoin and Ethereum, saw a significant recovery in the last 2 days, the macro still holds crypto under pressure. The ECB yesterday raised interest rates by another 75 bps despite recession fears, which caused the crypto market to reverse gains amid volatility.

The U.S. Fed will raise the interest rate at the FOMC meeting on November 2. The CME FedWatch Tool shows an 86.5% probability of a 75 bps rate hike. A week earlier, the probability was 95%.