Bitcoin prices have halted their free fall, bouncing off the previous cycle’s peak and returning above $22,000 today, but it could be undervalued according to Fidelity.

Bitcoin has lost a whopping 26% over the past week falling to an 18-month low of $20,193 on June 15. It has since regained a little composure returning to $22,344 at the time of writing, but the asset remains in the doldrums, down 67% from its all-time high.

Director of Global Macro at investment giant Fidelity, Jurrien Timmer, has been looking into the price-earnings ratio (P/E) for Bitcoin which equates to a price/network ratio since it is not a company.

According to the chart, the ratio has returned to the same levels it was during the cycle peaks of 2013 and 2017. He summarized that “valuation often is more important than price.”

Bitcoin valuation

A P/E ratio is used in traditional finance to value a company by measuring its current share price relative to its earnings per share. This doesn’t work for cryptocurrencies, so the price is measured against network activity. A similar way of looking at it is the network value to transactions ratio (NVT), as depicted by technical analyst Willy Woo.

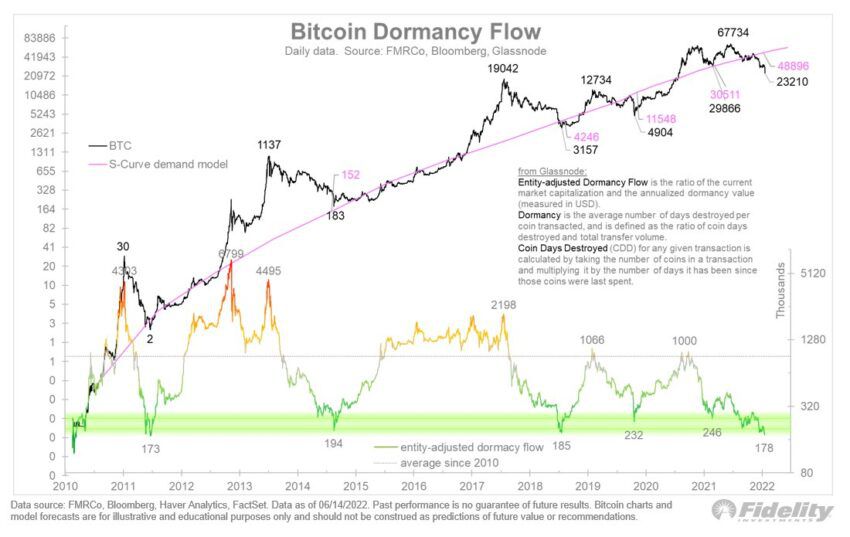

Timmer added that another way to highlight it is by overlaying Bitcoin’s non-zero addresses against its price. “Price is now below the network curve,” he observed. Using Glassnode’s Bitcoin Dormancy Flow model, he then showed how oversold the asset was at the moment. Bitcoin has not been this oversold since the capitulation events in 2011, 2014, and 2018.

This could be an indication that we are very close to the bottom of this market cycle and this week’s massive selloff may have been the final flush-out.

Final miner capitulation

There is one additional factor that could cause a final leg down, similar to the one in the 2018 market crash – Bitcoin miners.

Miners have been moving BTC to exchanges at record levels this week. CoinMetrics reported that there was an all-time high in dollar terms with a net $1.94 billion worth of BTC sent to exchanges yesterday. This equated to a record 88,000 coins in just one day.

Miners need to offload the asset to cover their increasing power expenses and remain in business for the crypto winter. This mass liquidation could cause another big dump echoing the over 80% drawdowns that occurred in previous cycles.

If this happens, Bitcoin prices could realistically fall to around $12,000 very quickly which would mark an 82% retreat from peak levels. Castle Island Ventures partner, Nic Carter, explained the forces behind this miner liquidation event in a recent tweet.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.