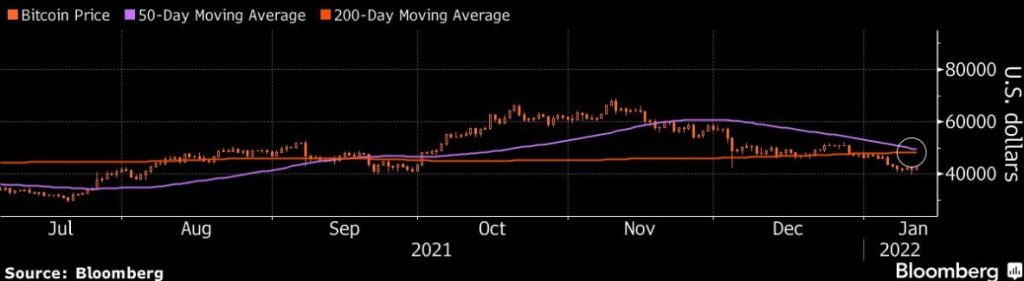

It has been a pretty rough start this year for Bitcoin 2022 as the BTC price corrected more than 10% in the first 12 days of January. On the technical chart, Bitcoin is approaching the death cross pattern that suggests that we might be heading for further pain ahead.

The death cross appears whenever the asset’s price over the last 50 days drops below that of its 200-day moving average. This signals that the momentum is headed downwards. Mati Greenspan, founder of Quantum Economics noted that Bitcoin is approaching a similar death cross pattern later this week. “The chart is pretty clear,” he said.

Bitcoin’s Track Record Around Death Cross

Although the death cross indicator hints at a bearish momentum, Bitcoin’s track record with the death cross remains mixed. Bitcoin managed to overcome the death cross risks during March 2020 and June 2021 and later surged higher to form a golden cross. However, in November 2019, Bitcoin started trading lower a month later following the death cross. Speaking on this matter, Greenspan told Bloomberg:

“Some people say it’s bearish, but for Bitcoin, just about all previous death crosses or golden crosses have proven to be a good buying opportunity, along with any other indicator under the sun for everyone who entered before 2021”.

Juthica Chou, head of OTC options trading at Kraken also added: “The history is really mixed — there’s no surprise given that some of the macro backdrop is affecting price action, but we’ve seen a healthy bounce over the last 24 hours. And I think the fundamentals are still really strong.”

After moving downside the last week, Bitcoin has been showing green shoots over the last two days. Moving away from the death cross, Bitcoin has gained 5% from the $40,000 support levels. Thanks to the strong miner accumulation! As of press time, Bitcoin is trading at $42,698 with a market cap of $806 billion.