Bitcoin’s [BTC] rejection of the $20K level last week led to the suffering of short-term holders. As per a latest Glassnode report short-term holders of the asset suffered significant unrealized losses.

HODLers have remained consistent and have continued to hold on to their supply despite the turbulence in the market. On the other hand, these holders were more interested in the best entry and exit prices.

Furthermore, according to Glassnode, these holders were “responsible for the majority coin movement, with a heavy concentration around the current market price.”

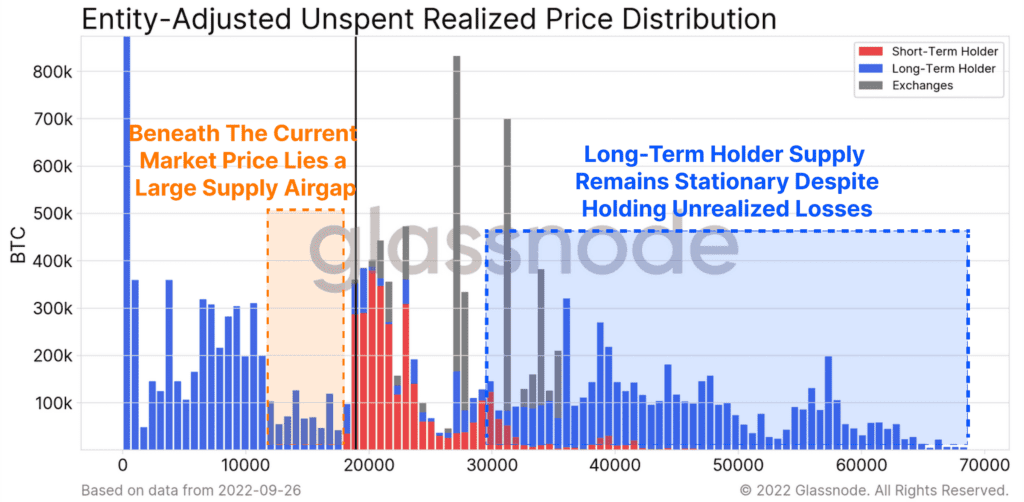

For the king coin, Glassnode found further that there exists a large supply air gap below the $18,000 price level. This supply gap extends to the $11,000- $12,000 price level. Should the price of BTC fall below the current cycle low, a significant amount of short-term holder coins will be plunged into unrealized loss.

Commenting on the impact of this on the general market, Glassnode stated that it “ may exacerbate downside reflexivity and trigger yet another wide-ranging capitulation event.”

Short-term holders in the current bear market

As stated above, short-term holders were more interested in the best entry and exit points than holding on to their supply. As a result, as the price of BTC declined further, short-term holders’ profitability fell as well. According to Glassnode, as these declines continue, “a point is reached (where) STH (short-term holders’) coins are clustered around spot prices, and thus their cost basis is in-phase with the market.”

As a result of the non-stop fall in the price of the asset, the profitability of short-term holders of BTC has remained “compressed” for the last 431 days. This, according to Glassnode, has been the longest duration in any bear market cycle since BTC was introduced.

In addition to considering the profitability level for short-term holders, Glassnode took a look at the Market Realized Gradient Oscillator metric as it relates to this category of holders. This was to determine the relative changes in momentum between the speculative value and true organic capital inflows from BTC’s short-term holders.

A look at the details

According to the report, three different phases can be identified here. First, there was a growth in momentum, and speculative capital exceeded organic capital inflows from BTC’s short-term holders. In this situation, the price of BTC rallies.

In the second phase, this rally led the price to clinch “unsustainable heights.” This was followed by a decline in price, which further led to an “initial wash-out of the STH cohort.”

In the last phase, Glassnode opined the direction of the market is headed. The price action momentum and the capital inflows from BTC’s short-term holders reached an equilibrium with the price. According to the report, this point of equilibrium was reached in the latest stages of a bear market where BTC sellers were gradually phased out of the market.

At press time, BTC traded at $20,196.12. In the last 24 hours, its price had gone up by 6%, per data from CoinMarketCap.