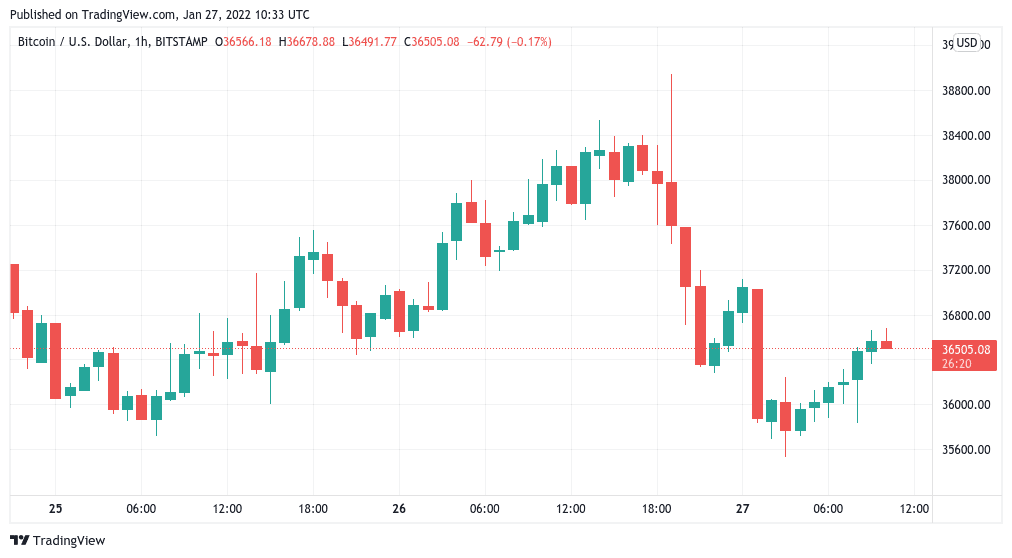

Bitcoin (BTC) climbed down from multi-day highs on Jan. 27 as the aftermath of the latest United States Federal Reserve meeting saw bulls taper their enthusiasm.

Bitcoin disappoints below $37,500

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD walking back some of its gains, which had topped out at $38,950 on Bitstamp.

The pair then refocused on $36,000, the level where it was trading at the time of writing.

As momentum gathered pace, market commentators began hoping for a stronger weekly close, possibly including a challenge of the $40,000 mark. Now, however, the mood was markedly less euphoric.

“Bitcoin rejected at $38K and hit the first important level of support at $36K here,” Cointelegraph contributor Michaël van de Poppe summarized to Twitter followers.

“Might have a short-term bounce, but anything sub $37.5K isn’t shouting for bullishness.”

Van de Poppe joined others in voicing dissatisfaction with the outcome of the Fed’s meeting, in particular with a lack of new insight and policy information from Fed Chair Jerome Powell.

“With inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate,” a statement by the Federal Open Market Committee read.

“The Committee decided to continue to reduce the monthly pace of its net asset purchases, bringing them to an end in early March.”

With that, crypto markets had few macro cues to react to, a paradigm shift in price behavior yet to make an appearance.

Crypto liquidations pass $300 million

Altcoins followed Bitcoin in step to shed several percentage points on the day, once more adding to the week’s overall losses.

Related: Bitcoin pundits split over BTC floor as Bloomberg analyst eyes bounce

Ether (ETH) fell back below $2,500, still down 22% over the past seven days.

Others fared somewhat better, with Dogecoin (DOGE) retaining most of its previous progress and Cardano (ADA) trading flat at $1.06.

Not everyone escaped unscathed post-Fed, however, with total cross-crypto liquidations passing $320 million, data from on-chain monitoring resource Coinglass confirmed.