- Bitcoin dipped below $30,000 for the first time since July 2021 as the crypto market went through its worst week in months with some like LUNA shedding 50 percent overnight.

- Analysts are grappling to explain the dip, with some blaming institutional investors as others warn that if BTC dips another 10 percent, the next support is $19,400.

The cryptocurrency market is going through one of its worst starts to a week in months. Bitcoin dipped below $30,000 for the first time in 10 months in Asian markets trading before recovering in European markets. LUNA is down by over 50 percent in the biggest dip among major cryptos, with Monero, ApeCoin, STEPN, and Lido DAO all losing over 10 percent.

At press time, BTC is trading at $31,570, down by 4 percent in the past day and 18 percent in the past week.

In that time, it has dipped to a low of $29,944, the first time it has breached the $30,000 support level since July 2021. The volume was in stark contrast as it went up 91 percent to hit $80.7 billion, the highest it has hit this year.

Edward Moya, a senior market analyst for the Americas at Oanda observed:

Bitcoin is breaking below some key technical levels as the never-ending selloff on Wall Street continues, The institutional investor is paying close attention to bitcoin as many who got in last year are now losing money on their investment.

Moya believes that BTC’s long-term fundamentals have not changed in months. However, concerns about a possible recession “are creating a very difficult environment for cryptos.”

Bitcoin has long been touted as the hedge against inflation and a safe-haven asset, but as experts have observed, this narrative has been debunked in recent times.

Daniel Ives told the Financial Times, “Some investors are playing crypto like a hedge against inflation, but it’s trading like the Nasdaq’s Siamese twin.” He added that investors are taking a risk-off approach to every asset, and crypto hasn’t been exempted.

What’s next for Bitcoin?

It could get worse for Bitcoin, some analysts believe. Chris Kline, the cofounder of Los Angeles-based Bitcoin IRA is one of those who believes that crypto has been depending a lot on a fresh infusion of capital and that once this dries up, it could get bleak.

The era of free money is over. There’s a large adjustment of investor appetite happening right now.

Moreover, investors might not be as confident in crypto as they would be in some other traditional assets, Kline added, stating:

The question mark is, will people see (crypto) as a diversification tool in bad economies? Or is it just something to have when times are good?

So what happens next? Well, according to Jeffrey Halley, a senior market analyst at Oanda, we might be headed to $17,000.

He commented:

That is a big call, and it does seem to be making a stand ahead of $30,000.00. Realistically, it needs to reclaim $37,000.00 to change the technical outlook and give the HODLers hope of a good night’s sleep.

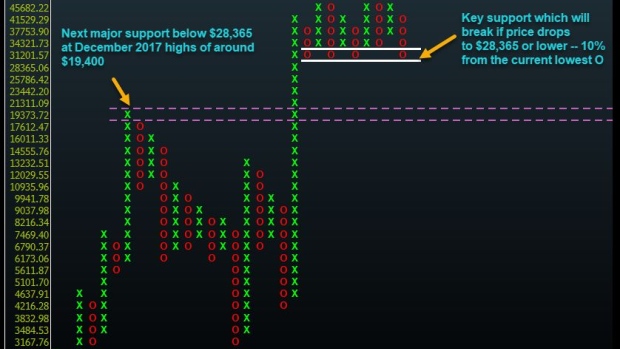

Bloomberg analysts have a similar view. According to them, if BTC slides down to $28,365, the next support could be $19,400, its last support level which stretches as far back as 2017.