The Bitcoin Dominance Rate (BTCD) is in the process of breaking down from a long-term support area, an event which would lead it towards a new all-time low.

On May 19, BTCD fell to a low of 39.66% and bounced. At first, it seemed as if the rate would initiate an upward movement. However, it created two lower highs instead, and is back at its May lows.

The decrease has served to validate the 38% area as support. BTCD has been trading above this level since the beginning of 2018. A decrease below it would likely cause a drop towards new all-time lows.

Technical indicators are bearish, supporting the possibility that BTCD will break down.

The MACD, which is created by a short- and a long-term moving average (MA), is negative. This means that the short-term MA is slower than the long-term one, and is a sign of bearish trends. Furthermore, the histogram is losing strength and dropping (red icon).

The RSI, which is a momentum indicator, is also bearish. While it previously generated bullish divergence (Green line), it has broken its trendline and is now falling. In addition to this, it is below 50.

Therefore, a breakdown from the 38% area seems likely.

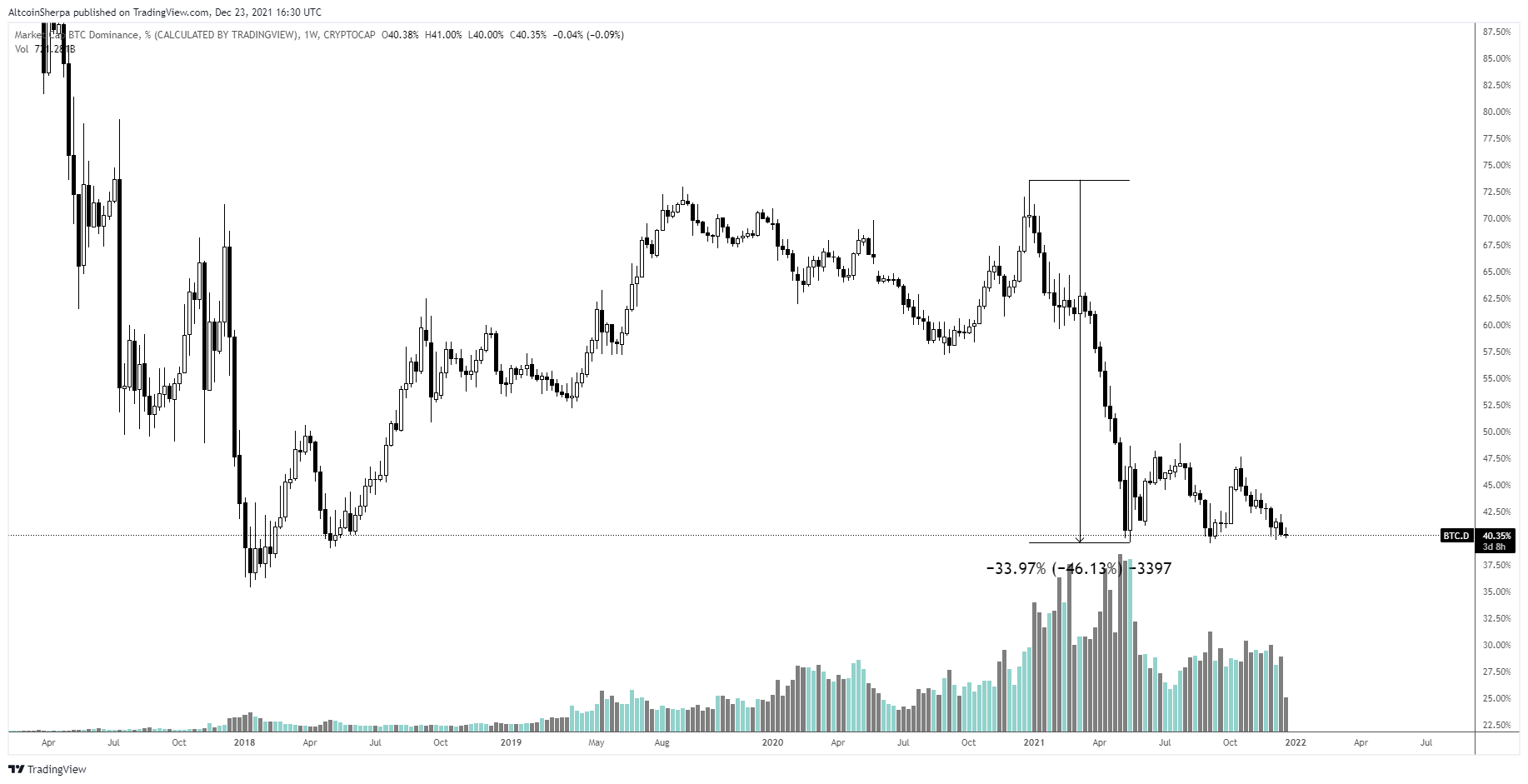

Cryptocurrency trader @AltcoinSherpa outlined a BTCD chart, which shows that the rate has fallen by 46% since the yearly highs. As outlined above, it seems that the downward movement will continue.

Ongoing decrease

The daily chart provides a similar outlook. BTCD has been decreasing alongside a descending resistance line since Oct 20.

While the MACD and the RSI had both initially generated bullish divergences, the RSI broke from the trendline, while the MACD invalidated the divergence altogether.

Therefore, the breakdown and continuation of the downward movement towards a new all-time low seems likely.

Future BTCD movement

The entire decrease since the beginning of the year looks like a five wave downward movement, in which BTCD is currently in the fifth and final wave.

A potential target for the bottom of the entire movement is at 27%. The target is created using the 2.61 external Fib retracement (white) of wave four. In addition to this, more confluence is given by the 0.618 length of waves 1-3 (black), which gives a nearly identical target.

Afterwards, an upward movement would be expected.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.