The Bitcoin Dominance Rate (BTCD) is trading at a confluence of support levels in both the weekly and daily timeframes. If the ongoing upward movement is to continue, the current support level would be expected to initiate a bounce.

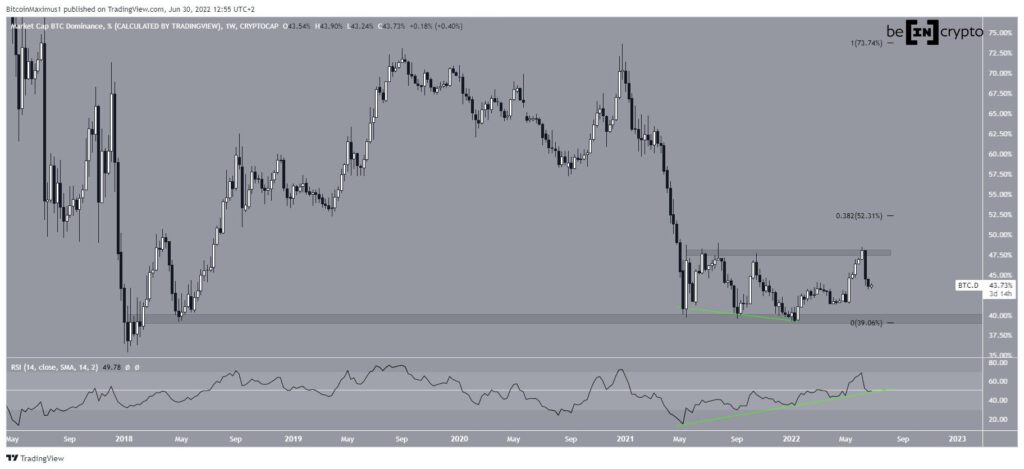

Between May-Dec. 2021, BTCD created a triple bottom pattern at the 40% long-term support area. The triple bottom is considered a bullish pattern. Thus, it is expected to lead to breakouts the vast majority of the time.

Supporting this possibility, the weekly RSI also generated a very significant bullish divergence. The divergence trendline (green) is still intact, and the RSI is right at 50. So, the current level on the weekly chart offers a great possibility for a bounce.

So far, BTCD has been rejected by the 47.50% horizontal resistance area. If it were successful in moving above it, the next resistance is at 52.30%.

Future BTCD movement

Well-known futures trader @peterlbrandt posted a chart of BTCD, stating that a close above 50% would be a very strong sign that BTC is moving higher.

The daily chart shows that BTCD has broken out from a descending resistance line. However, after the rejection, it fell to a confluence of support levels at 43%.

This support is created by the 0.618 Fib retracement support level and an ascending support line.

So, in alignment with the weekly chart, the daily one indicates that a bounce at the current level would be likely.

The two-hour chart supports this possibility, suggesting that a bounce is likely. The main reason for this is that the six-hour RSI has generated a very significant bullish divergence, and is now above 50.

If an upward movement does begin, the first resistance area would be at 45%, created by the 0.382 Fib retracement resistance level.

For Be[in]Crypto’s latest bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.