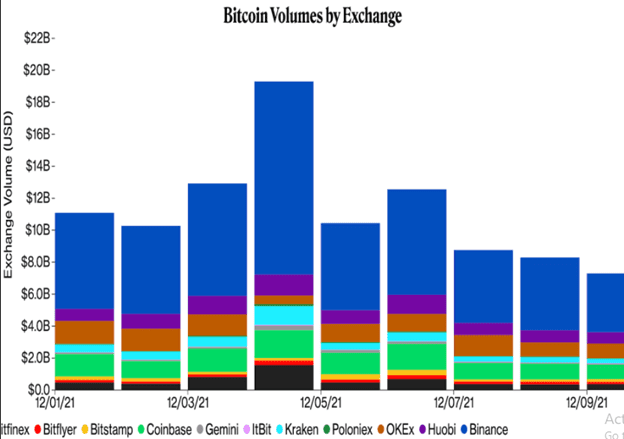

- Bitcoin dropped below $49,000 and the trading volume continues to dip.

- The majority of the crypto market was also red.

- Bearish market happened as US stocks slipped and the US dollar index (DXY).

Bitcoin fell to $48,000 on Thursday. Meanwhile, the trading volume of the most prominent crypto by market cap on the centralized exchange continues to decline. In addition, the Bitcoin loss is nearly 5% after hovering above $50,000 in the past two days.

At the same time, most of the crypto markets are down in red. In fact, Ethereum, the second-largest crypto, dropped more than 5% to around $4,100. The bearish market arrived as US stocks slipped and the US dollar index (DXY), which tracks the value of the greenback against major fiat currencies, increased by 0.2%.

Senior Market Analyst at Oanda, Edward Moya said:

The long-term bullish fall remains for Bitcoin, but in the short-term everything looks bearish. An extended altcoin season and short-term bearish sentiment in risky assets as Omicron regains momentum.

Likewise, Bitcoin continues to struggle below $50,000 resistance.

Last month’s short-term downtrend endures in place, which could restrict profits to over $50,000 to $60,000.

Bitcoin declined approximately 2% in the past 24 hours, although the support around the 200-day moving average (currently at $46,500) could restrain the current pullback.

Furthermore, the BTC buying movement remains weak despite some oversold signs on the chart. This decreases the chances of an effective upward trend in the new year, especially as the upward momentum on the weekly and monthly charts continue to weaken.