On-chain data shows that $44.2 million in Bitcoin was dumped in just one minute, following which the price of BTC declined to $46k.

Exchanges Observe Huge Bitcoin Inflow Of 1923 BTC

As pointed out by an analyst in a CryptoQuant post, on-chain data shows that around1923 BTC entered exchange wallets today.

The relevant indicator here is the “inflow” metric, which measures the total amount of Bitcoin being transferred to exchanges.

Since investors usually transfer their coins to exchanges for withdrawing to fiat or for purchasing altcoins with them, big inflow values can be bearish for the price of the crypto.

On the other hand, low inflow values can be bullish for Bitcoin as they may mean there isn’t much selling pressure in the market at the moment.

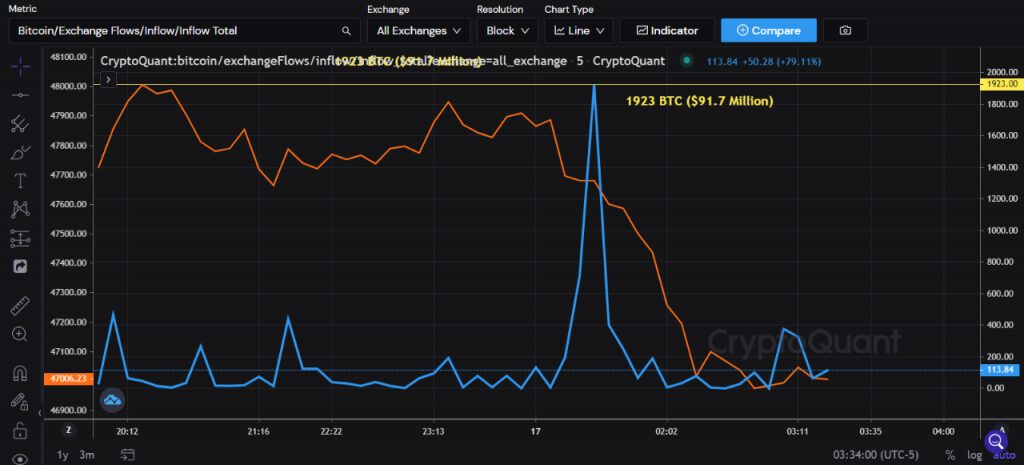

Now, here is a chart that shows the trend in BTC inflows over the past day:

Looks like the indicator showed a huge spike today | Source: CryptoQuant

As you can see in the above graph, the inflow indicator showed a massive spike today that measured to be around 1923 BTC.

This means that some holders deposited to exchange wallets what was around $91.7 million at the time of the transaction. Not long after, the price of BTC dropped down to $46.7k.

Related Reading | Data Shows Bitcoin Short-Term Holders Realizing Significant Losses

A look at the “taker sell volume” chart reveals some additional info about this decline. This metric is another on-chain indicator that shows the total amount of sell orders on perpetual swaps.

The indicator's value seems to have surged today | Source: CryptoQuant

On examining this graph, it becomes apparent that around $44.2 million in sell orders were placed on perpetual swap exchanges about 50 minutes after the aforementioned inflows. All this Bitcoin volume was dumped within the matter of a minute.

Related Reading | Bitcoin Heads For Short Squeeze? Why ETH Could Outperform In This Scenario

Because of the short timeframe, it’s looking likely it was just a single investor selling these coins. It’s also possible that rather than a single holder, it could be a group pulling off a coordinated dump.

The analyst in the post believes this might cause further fear and inflows in the Bitcoin market, and so investors should remain vigilant.

BTC Price

At the time of writing, Bitcoin’s price floats around $47k, down 4% in the last seven days. Over the past month, the crypto has lost 21% in value.

Here is a chart that shows the trend in the price of BTC over the last five days:

BTC's price dropped down to $46.7k earlier in the day, but has since recovered back above $47k | Source: BTCUSD on TradingView

Bitcoin has been in consolidation within the $45k to $50k range for a while now, and the trend doesn’t look to be breaking anytime soon.

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com