The price of major cryptocurrencies soared on Wednesday after the Federal Reserve announced that it will accelerate the tapering of its asset purchases, with the program set to expire in March, and that the benchmark interest rate would be raised three times next year.

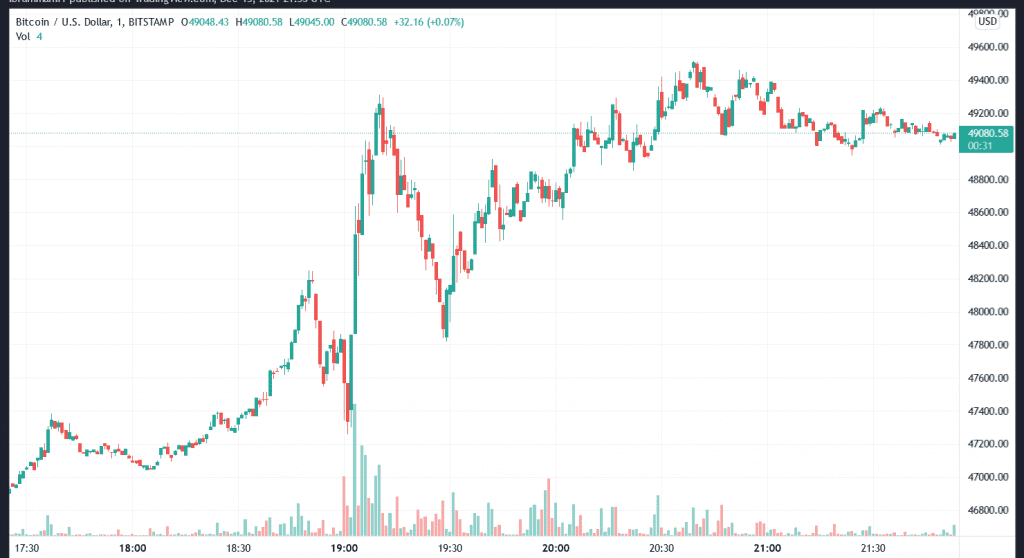

Following the Fed’s announcement, Bitcoin soared from roughly $47,800 to over $49,350. The cryptocurrency is currently worth $49,080, up 2.2 percent in the last 24 hours. Ethereum was at above $4k at press time.

Tapering Scared Investors Off

The crypto market may have already factored in the Fed’s decision to accelerate tapering. Bitcoin has lost more than a quarter of its value since hitting an all-time high of $68,991 in November. Ether has dropped more than 15% from its all-time high of $4,865.6.

Major cryptocurrencies were likely to surge if the Fed was less aggressive than the market predicted, according to several traders. “We’ve been in a risk-off environment in bitcoin and the crypto asset broadly over the last month,” Louis LaValle, managing director at crypto fund manager 3iQ Digital Assets, said. “If the FOMC (Federal Open Market Committee) meeting doesn’t make blockbuster headlines, that could be a buying opportunity for those on the sidelines.”

Powell stated in November that the Fed will “start to reduce the pace of asset purchases,” prompting many to believe that an interest rate hike would be announced at today’s meeting. President Biden recently re-nominated Federal Reserve Chair Jerome Powell for a second term

Related article | New COVID Variant FUD Drives Bitcoin Down To $54k

The reverse of Quantitative Easing programs, such as asset purchases and so-called “money printing” is known as tapering. Each month, the Fed buys $40 billion in US Agency Securities and $80 billion in US Treasury Securities. Stock prices have fallen as a result of the anxieties, as tapering tactics are known to trigger economic downturns.

According to today’s Fed statement, the interest rate will continue around zero until complete employment recovery to pre-Covid levels is achieved. With new instances of the Omicron Covid variant reaching record highs in both the United States and the United Kingdom today, this is unlikely to happen anytime soon

Bitcoin Spikes | Source: BTCUSD on TradingView.com

Bitcoin Is Seen As Hedge But Volatility Threatens

Many investors consider the largest cryptocurrency by market cap to be a hedge against inflation, owing to the belief that its supply is strictly limited by the programming embedded into the underlying blockchain. The Federal Reserve’s human-decided monetary policies, which have inflated its balance sheet to approximately $8.7 trillion, more than double where it was in early 2020, contrast with that hard-coded procedure.

However, because bitcoin is seen as a hazardous asset, traders believe that loose monetary policies encourage investors to make larger speculative wagers. A shift away from these “dovish” policies could be a drag on bitcoin.

It’s also unclear whether an unusually high number of Covid-19 cases will frighten financial markets, and if so, whether a Bitcoin bloodbath will follow suit, as it did in March 2020.

Related article | Why Bitcoin Could Be Stronger Than Ever After COVID-19 Pandemic Passes

Featured image from Unsplash.com, charts from TradingView.com