Key Takeaways

- Bitcoin whales are selling or redistributing their tokens.

- Retail interest for Ethereum has also declined.

- The top two cryptocurrencies are at risk of major sell-offs.

Share this article

Volatility has struck the cryptocurrency market, leading to more than $160 million in liquidations over the past 24 hours. Bitcoin and Ethereum are now sitting on top of weak support, posing the risk of further losses.

Bitcoin and Ethereum Retrace

Bitcoin and Ethereum’s on-chain activity looks precarious, and without a significant improvement, the top two cryptocurrencies could suffer from major corrections.

Bitcoin appears to have developed a Bart pattern following a Tuesday downturn. Bitcoin rose from a low of $18,700 and briefly broke out to $20,390 Tuesday. However, it’s since retraced, erasing its gains to hit a low of $18,480.

From an on-chain perspective, investors are showing little interest in accumulating Bitcoin at current prices. Addresses holding between 1,000 and 10,000 Bitcoin have sold or redistributed roughly 50,000 coins worth around $950 million over the past week. The mounting selling pressure could soon take a toll on Bitcoin’s price.

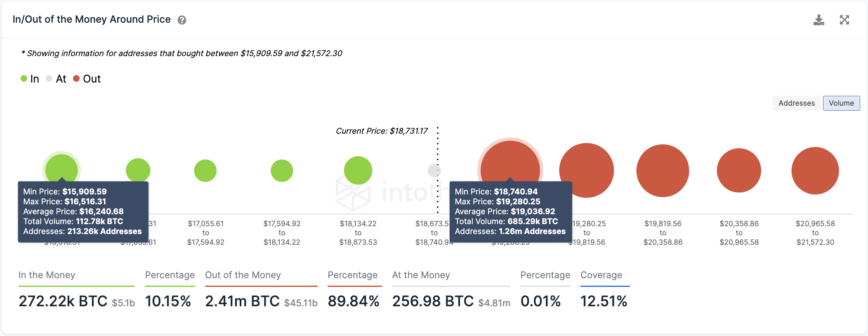

Transaction history shows that Bitcoin is sitting below a significant supply wall with few considerable demand walls underneath it. Around 1.26 million addresses purchased 685,000 Bitcoin at an average price of $19,000. Another downswing could encourage these investors to exit their positions to avoid further losses. Given the lack of support levels, Bitcoin could suffer a drop toward $16,240.

Bitcoin needs to reclaim the $19,000 level as support as soon as possible to have a chance of invalidating the pessimistic outlook. If it succeeds, it could march toward the recent $20,390 high, marking a crucial break above the $20,000 psychological level.

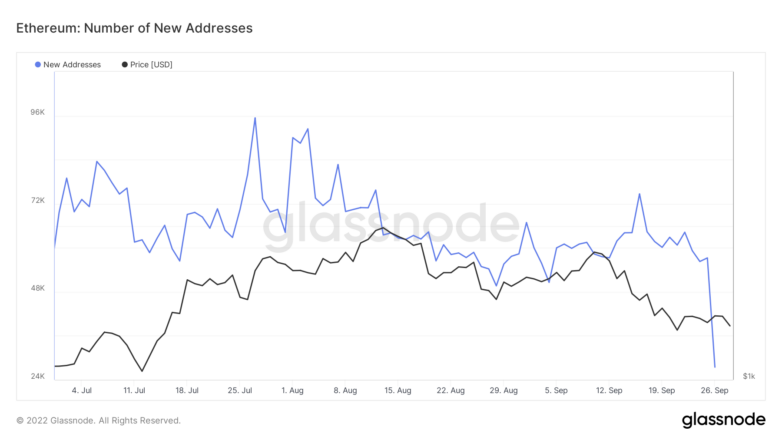

Ethereum has also seen high volatility over the past 24 hours, shedding nearly 150 points in market value. The erratic price behavior coincides with a significant decline in on-chain activity. The number of new ETH addresses created per day dropped by more than 50% after hovering over 60,000 addresses in the past week.

Generally, a steady decline in the number of new addresses created on a given blockchain leads to a steep price correction over time.

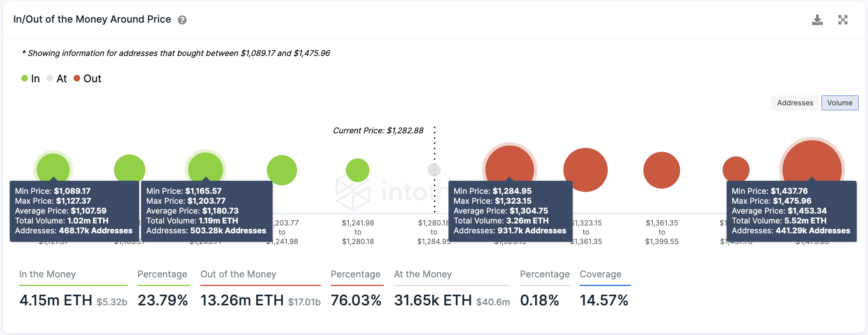

IntoTheBlock’s IOMAP model shows that further downward pressure could take Ethereum to $1,180, where 500,000 addresses hold around 1.19 million ETH. But if this support level fails to hold, the correction could extend toward $1,000.

Ethereum must climb and print a daily close above $1,300 to invalidate the bearish thesis. If it succeeds, it could recover and ascend toward $1,450.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH. The information contained in this piece is for educational purposes only and is not investment advice.

For more key market trends, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.

https://youtube.com/watch?v=+lastest&list=PLzVqSd7dOZae9P5oIZI1lMeWPwhAxcOW8&controls=0