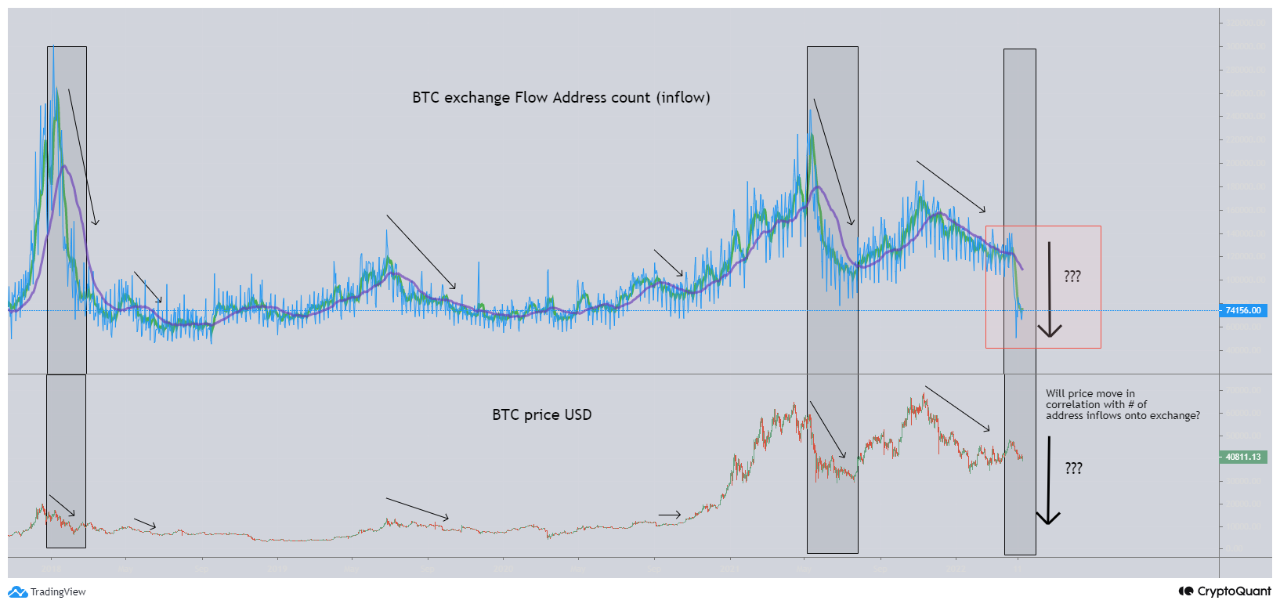

Data from on-chain analytics firm CryptoQuant has revealed that the address count of BTC inflows and outflows going onto exchanges has been decreasing at a tremendous rate. As a result, market analyst ‘Yaso’ believes that a significant price correction may be imminent.

A Mammoth Price Correction?

The address count on BTC exchange flows has dropped significantly since the start of April, according to CryptoQuant. The exchange flow, which involves both outflows and inflows, is a metric that has served as a good indicator of the asset’s price action.

According to the analytics firm, Bitcoin is strongly correlated with this on-chain metric. Significant drops in this metric have also led to corresponding price corrections of the leading digital asset by market cap.

Notably, CoinShares on Tuesday also reported that Bitcoin investment products had seen outflows for the second consecutive week. According to the firm, Bitcoin had seen outflows of $73 million. However, CoinShares data also reveals that short-sellers have closed their positions, a possible positive for the asset in the short term.

Presently, Bitcoin is trading at around the $39,586 price point, down 6% from its opening price yesterday.

According to CryptoQuant, in a bullish scenario, it could mean that the market has already priced in the drop in exchange flow address count, and we will see an increase in inflows and outflows. But, on the other hand, the crypto asset may experience a more serious price correction.

Bitcoin Not Yet Seen By A Majority Of Investors As A “Store Of Value“

Bitcoin in recent times has continued to correlate with tech stocks. A new report from Arcane Research disclosed that the correlation between Bitcoin and the Nasdaq 100 (NDX), a stock index composed mainly of tech stocks, is at 0.7, where a score of 1 would mean they move in precisely the same way.

The recent correlation is one that BitMEX’s Arthur Hayes has identified and used as the basis of his prediction that the market will crash in June. According to Hayes, Bitcoin, in June, may drop as low as $30k, provided the Fed continues to raise rates.

While proponents champion Bitcoin as digital gold and a hedge against inflation and other economic shocks, recent trends prove otherwise. Though Bitcoin has all the suitable properties to be a risk-off asset, several investors still see it as risk-on due to its volatility and tech stock-like upside potential. So while theoretically, Bitcoin is an excellent store of value, it will not behave as one till a large majority of investors buy the narrative.