We’ve discussed a few points previously about adding Bitcoin to the treasury of a small business, in order to address inflation as well as provide other benefits. Of course, one could acquire Bitcoin by simply taking the U.S. dollar (or other local fiat currency) and buying Bitcoin through an exchange. But there is another valuable route that any business should consider: accepting Bitcoin in exchange for goods and services.

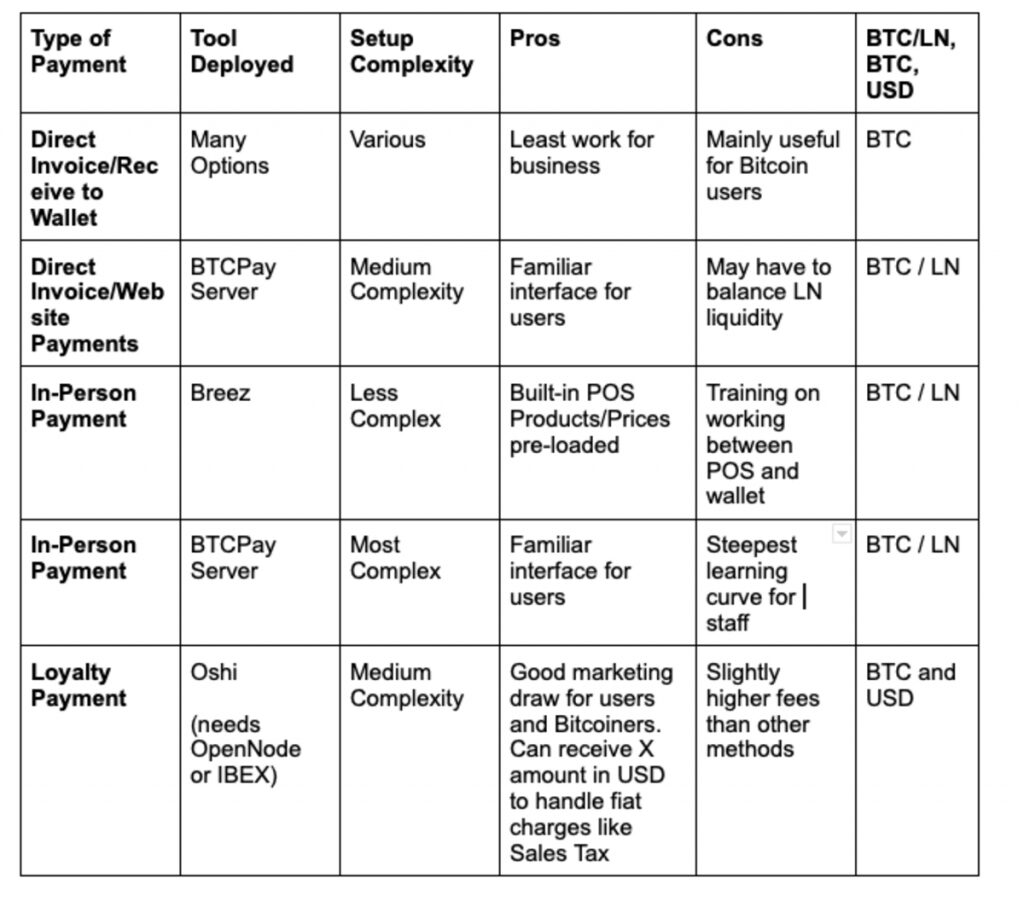

Below, we describe a few options that we have used for the small businesses that I’ve worked with. All of these businesses have employees, and are not sole-proprietorships, so we leave out options that may work fine when you’re the only employee. Once you have employees, the business has additional concerns around training, ease of use and cash controls. The options below are the easiest I’ve found so far.

Advantages Of Bitcoin Payments

In addition to avoiding the transaction fees charged by all exchanges, receiving payment in bitcoin provides other advantages. First, in many cases the traditional payment rails impose somewhat significant costs (credit card fees, cash deposit fees and other payment processing overhead). Bitcoin can, in many cases, reduce these costs resulting in a few percentage points of extra revenue, without adjusting pricing.

If your customers are paying with ACH or paper checks, you already have pretty low monetary and time costs to receive that money. In those cases, receiving Bitcoin may not reduce your costs by much (though we have increasingly seen banks charging by the item for these services too, and they’ve indicated it will likely get worse over time). However, for wires or credit card payments by phone, receiving Bitcoin will enable lower monetary and time-use costs.

Invoicing And Receiving Directly In Bitcoin

Perhaps the simplest method is for businesses that send out invoices for payment: it can be as easy as including an on-chain receive address on the invoice itself.

This receive address could be generated anew for each invoice, or each customer could have a static one that is assigned to them. While making a new address for each invoice may sound like a bit of a pain, it provides several advantages, both for privacy and security reasons and for accounting. Of course, while also technically possible to just use one receive address for everything, that’s really not a great idea as it would make bookkeeping harder later, while also potentially damaging your customers’ privacy.

In its most basic application, this method doesn’t even need much in the way of special software, and it is very easy to execute in a self-custody manner. At the simplest, just taking extended public keys and generating many receive addresses and assigning them to customers or invoices (perhaps in a spreadsheet) is all that would be required.

Invoicing And Receiving Website Payments

This is basically an extension of invoicing in bitcoin, but given the automated nature, it typically will require a service to run it. At one business we worked with we set up BTCPay Server to accept Bitcoin payments on their website. This is not as trivial as setting up a generic e-commerce store, but we found it really only needs a few extra steps (at least when using WordPress and Woocommerce; other e-commerce platforms may be more or less complicated). With the speed of development by the BTCPay Server team, it is likely that this will become much easier very quickly.

Point Of Sale (POS) Payments In Person

Here we get to the area that we believe is the most difficult realm for many small businesses. While some businesses, such as a vendor at a local farmer’s market, may have some tools that are easy to deploy, others, such as a restaurant or hotel, have some additional complexities that take some thought to work through.

These businesses have several additional concerns and complexities that an invoicing or web business doesn’t necessarily face:

- Efficient Customer Service. Your customer is right in front of you, and there may be other customers waiting, so the process needs to be seamless and quick — both on the Bitcoin side and on the user interface side.

- Efficient Integration with Current Point of Sale. Even if the Bitcoin/LN payment process itself is painless, you are likely switching back and forth between your normal POS app and your Bitcoin app.

If any of this takes too long, it may frustrate your customers. Probably not the Bitcoiner at this point in time, but those waiting in line may actually get annoyed at both the business and Bitcoin.

In the case of a business with a limited number of staff (like that market stand), a simple bitcoin and Lightning wallet may be all that is required. We have found that Breez wallet is a great solution for this, as they have a light-weight POS built in that allows one to have products and prices pre-loaded. In addition, the Breez POS can be configured to prevent front-line employees from seeing the wallet balance, or sending funds from the wallet.

Of course, BTCPay Server can also be used here, and Anthony Feliciano recently discussed this application at a Denver, Colorado brewery. While I’ve not personally used this method in the businesses we work with, it is a great option if it works for the business.

Of course, better POS software with integrated Bitcoin and LN payments will mitigate some of this (looking at you @jack!), but we’re not there yet.

Point Of Sale Payments With A Loyalty Program

Another platform that I’ve used is Oshi. Oshi is unique in that it feels like other coupon apps (such as Groupon), but is entirely Bitcoin based. In that vein, it is extremely easy to integrate into the checkout flow of a business that has used those other apps in the past. Also, since Oshi allows the use of OpenNode or IBEX as a back-end, the business can choose to receive either bitcoin or USD, in any proportion they desire. Also, because of the way it’s built, in Oshi it is not possible for employees to steal funds from the wallet.

Because the business can choose how much Bitcoin to get, they can enable customers to pay in bitcoin, even if they’re not yet ready to take the plunge. Also, they can, for instance, have a portion of the payment be sent to their bank account as USD, perhaps ensuring that the sales tax portion is covered without any exchange rate risk.

On the loyalty side, Oshi is very interesting. In addition to providing a directory of Oshi-enabled businesses, you can incentivize customers to pay in Bitcoin by giving discounts and sats back. Bitcoiners are a very loyal bunch, and if there are options, many will choose the Bitcoin-enabled business just for that reason, and an added discount (recognizing that you’re receiving the best money on Earth!) is always appreciated.

One small detail with Oshi is the fact that setting up OpenNode or IBEXis somewhat involved from a documentation standpoint. In order to convert to USD or withdraw the bitcoin, you have to go through business KYC, which is more like setting up a bank account than a normal Bitcoin service. Most businesses won’t have an issue with this, but it is something to recognize because it does mean it will probably take a couple of business days to get fully set up. They’ve also recently added a Square gift-card integration, though we have not used that feature myself.

Summary: Some Bitcoin Business Options

Sovereignty-Seeking Businesses Can Move Towards Bitcoin And Save On Legacy Transaction Fees

Now, more than ever before, Bitcoin is starting to move into the mainstream transactional flow. We know it’s totally possible due to El Salvador, but we also know it’ll be a longer roll out in places where Bitcoin isn’t an official currency. That said, the killer app would be for a mainstream POS enabling native Bitcoin payments, but until that happens, cutting edge businesses can continue to push the envelope — and save on transaction fees while also clawing back some of their sovereignty.

This is a guest post by Colin Crossman, Mark Maraia and Heidi Porter. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.