On-chain data shows Bitcoin funding rates have sunk into deep negative values, something that could pave way for a short squeeze in the market.

Bitcoin All Exchanges Funding Rate Has A Red Value Right Now

As pointed out by an analyst in a CryptoQuant post, BTC may see a slight uplift in the short term because of the current funding rates.

The “funding rate” is an indicator that measures the periodic fee that Bitcoin futures long and short traders exchange between each other.

When the value of this metric is positive, it means longs are paying a premium to the shorts right now to hold onto their positions.

Since there are more longs in the market, such a trend shows that a bullish sentiment is dominant in the futures market at the moment.

Related Reading | Is Coinbase Losing Its Edge? Nano Bitcoin Futures Sees Low Interest

On the other hand, negative values of the funding rate imply that there are more shorts in the market currently, and that the overall sentiment is bearish right now.

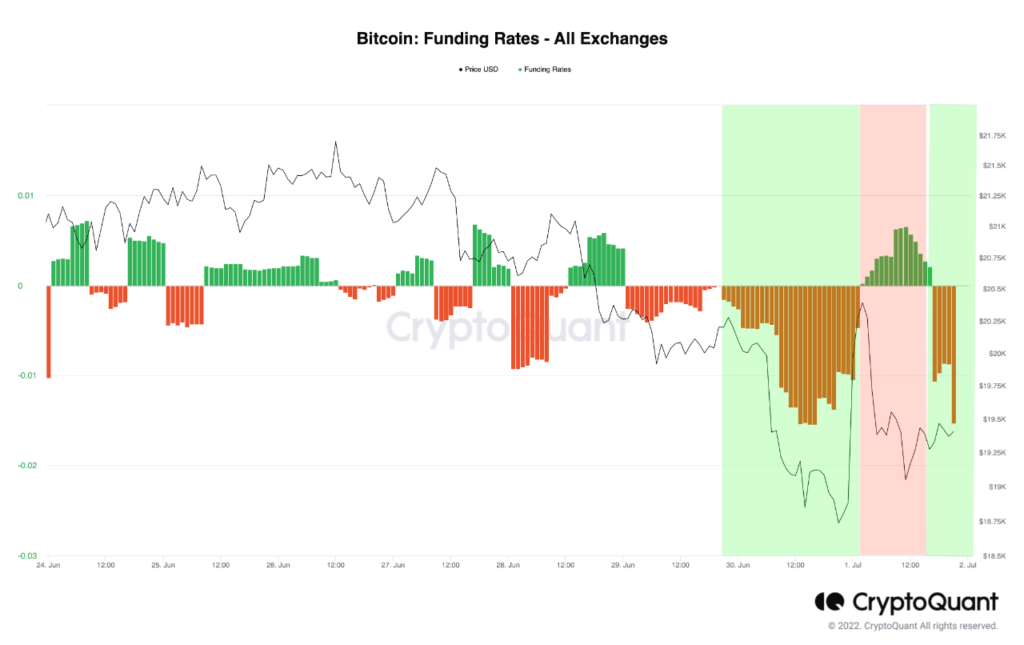

The below chart shows the trend in the all exchanges Bitcoin funding rates over the last week.

The value of the indicator seems to be less than zero at the moment | Source: CryptoQuant

As you can see in the above graph, the Bitcoin funding rate has gone down over the past day and has a relatively negative value right now.

This means that futures traders are piling up shorts in the market, A similar trend also took place just a couple of days back as the chart shows.

Related Reading | Samsung To Make Chips That Can Power Bitcoin Mining – Will This Energize Crypto?

Back then, the price reversed upwards sharply and caused a short squeeze, which further amplified the price swing.

A “short squeeze” occurs when mass liquidations of short traders take place due to a sudden sharp swing in the price.

Large liquidations further move Bitcoin in the direction of the reversal, causing even more leverage to be flushed. In this way, liquidations cascade together and the event is called a “squeeze.”

Since shorts are accumulating in the BTC futures market right now, it’s possible that a swing in the price could cause such a squeeze, bringing some uplift for the crypto.

However, just like a couple of days ago, it’s likely that such liquidations would only provide an increase in the short term.

BTC Price

At the time of writing, Bitcoin’s price floats around $19.2k, down 9% in the past week. The below chart shows the trend in the value of the crypto over the last five days.

Looks like the price of the coin has sunk down over the last few days | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com