On-chain data shows the Bitcoin funding rates have mostly remained negative for more than a week now. If past trend is anything to go by, this may mean that a bottom could be near.

Bitcoin Funding Rates Have Now Remained Mostly Negative For More Than Seven Days

As pointed out by an analyst in a CryptoQuant post, the Bitcoin funding rates have been negative in the past week for the most part.

The “funding rates” is an indicator that measures the periodic fee Bitcoin futures traders have to pay each other in order to hold onto their positions.

When the value of this indicator is positive, it means long holders are currently dominant and are paying a premium to short traders. Such values occur when the market sentiment is majorly bullish.

On the other hand, negative funding rates imply shorts now outweigh the longs and are willing to pay a fee to the longs. This kind of trend may show that the majority sentiment among traders is bearish at the moment.

Related Reading | Why Bitcoin Could Hit $90K By The End Of 2022, According To This Prediction

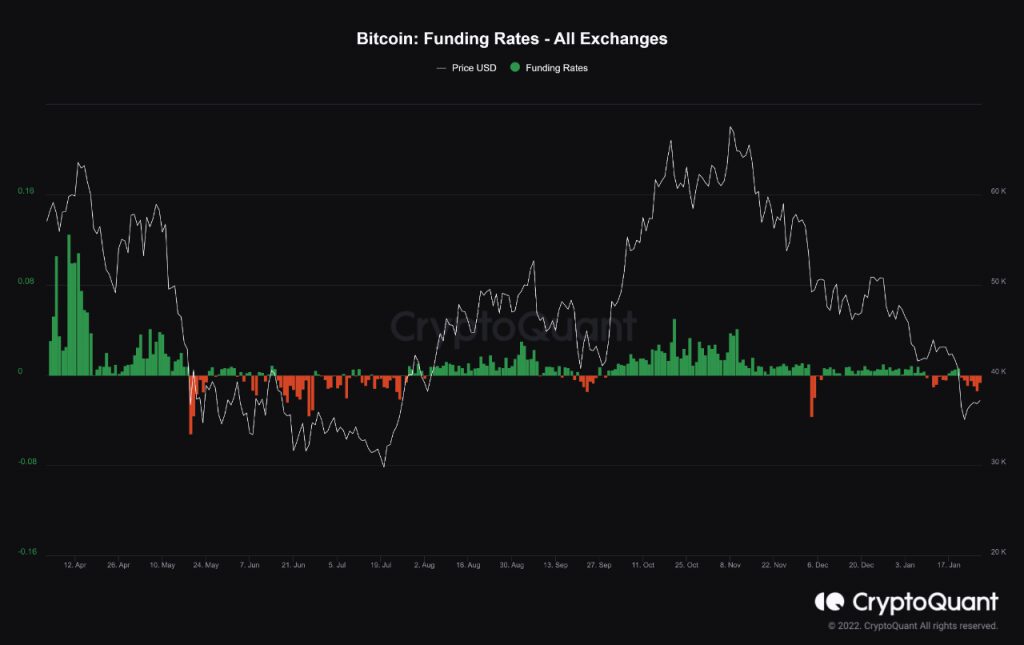

Now, here is a chart that highlights the trend in the BTC funding rates since April of last year:

Looks like the value of the indicator has been negative recently | Source: CryptoQuant

As you can see in the above graph, the Bitcoin funding rates have been mostly negative for more than a week now.

Related Reading | This Bitcoin Volatility Index Pattern Suggests A Short Squeeze May Be Near

Such values suggest that the sentiment among the majority of the futures market traders seems to be bearish right now.

In the chart, it’s also visible that the last time such negative funding rates stuck for longer than this was back in during the mini-bear market between May and July 2021. In this period, a bottom formation occurred.

Because of this, the quant in the post notes that the current negative funding rates may provide the ideal conditions for a trend reversal.

BTC Price

At the time of writing, Bitcoin’s price floats around $37.3k, up 11% in the last seven days. Over the past month, the crypto has lost 20% in value.

The below chart shows the trend in the price of BTC over the last five days.

BTC's price has mostly moved sideways in the last few days | Source: BTCUSD on TradingView

A couple of days back, Bitcoin’s price touched as high as $38.6k, before coming back down to the current levels. At the moment, it’s unclear when the coin’s price may recover, but if the funding rates are anything to consider, a bottom can form in the current conditions.

However, it’s worth noting that during the May-July consolidation it took more around three months of negative funding rates before the bottom formation.

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com