Bitcoin markets have just experienced another round of leveraged derivatives induced flush-outs. This is at least the fifth time during this bull cycle that over-leveraged traders have gotten stopped out and liquidated.

Derivatives markets have yet again caused increased volatility and a correction that has resulted in Bitcoin dumping thousands of dollars over the past couple of weeks.

These derivative flush outs have become a natural part of market cycles and can sometimes be used to indicate local tops and bottoms.

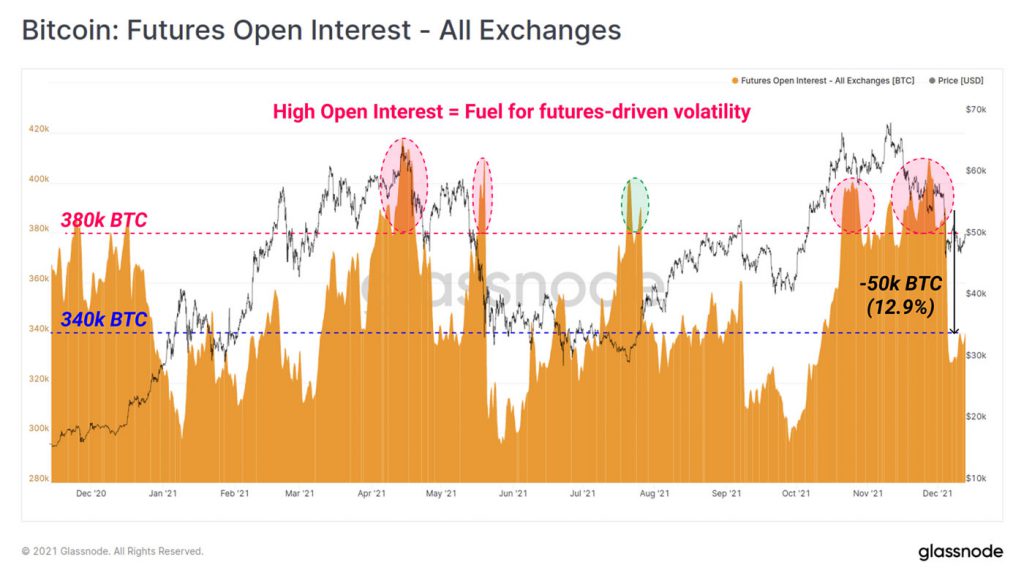

Open Interest is one measure that can be used to suggest whether markets are still in frenzy mode or that things have calmed down. OI is a measure of the total number of outstanding derivative futures contracts that have not been settled. The higher the OI value, the more volatility is to be expected when the contracts expire or are liquidated.

OI falls to healthier levels

OI has dropped around $2.5 billion over the past week or so according to analytics provider Glassnode. When this happens it is usually a sign that the flush-out has completed, those over-leveraged longs have been liquidated, and markets can settle.

Glassnode added that the influence of futures markets on price is particularly dominant during periods where OI climbs above the 380K BTC level. Since the beginning of the month, it has fallen by more than 50K BTC to the 330K BTC level which is much healthier.

Over the past week or so, OI has started to slowly climb which could suggest further volatility. However, Glassnode pointed out that after a deleveraging event, spot markets and on-chain activity usually have more impact on price movements. It added that perpetual futures OI as a proportion of the bitcoin market capitalization has fallen to a much healthier level:

This further supports that a meaningful deleveraging event has occurred, and the market appears to be responding with caution, rather than levering up once again.

Bitcoin finds support

BTC prices fell to an intraday and 10-week low of just under $46,000 during the late hours of Dec 13, but prices started consolidating during the morning of Dec 14.

There is strong support at the $46,500 level, which is where the 200-day moving average, a long-term trend indicator, lies. At the time of press, BTC was changing hands for $47,400 according to CoinGecko.

There has been reported dip buying on crypto Twitter, and now that the leverage has been flushed again, this could form another local bottom if the year-long bull market is to resume.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.