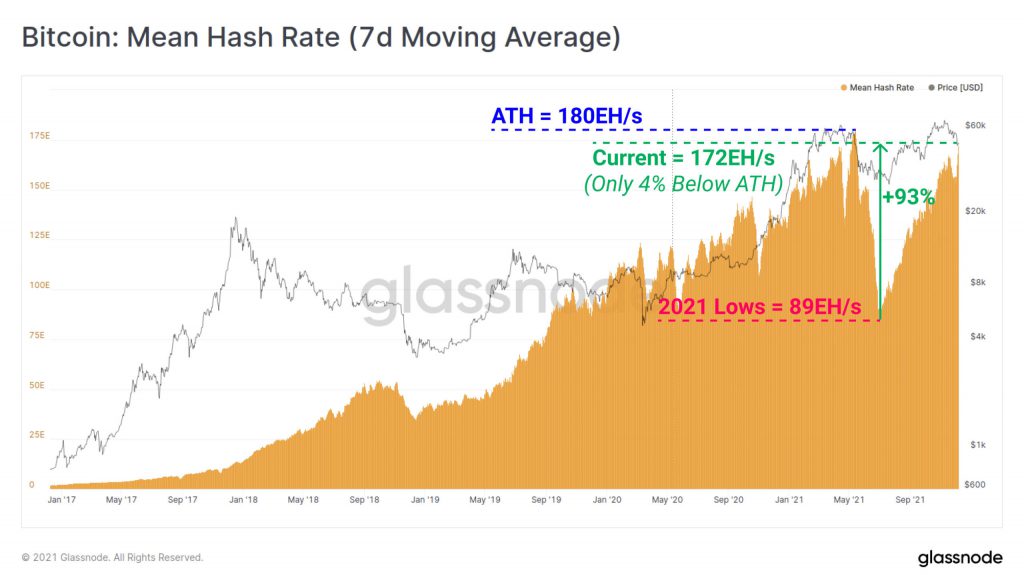

The hash rate of the Bitcoin network is nearly back at pre-crash levels as it closes in on a new all-time high.

On-chain analytics provider Glassnode has observed the major rebound in the Bitcoin network hash rate. On Dec 8, it reported that the hash rate is now just 4% away from its all-time high of 180 EH/s (exahashes per second) which occurred in mid-May.

The current hash rate according to Glassnode is 172 EH/s — a recovery of 93% from its 2021 low of 93 EH/s at the end of June.

The hashr ate can be described as computing horsepower — the higher the value is, the more secure the network becomes.

BitInfoCharts, which measures the average hash rate, is currently reporting 179 EH/s, the Bitcoin network’s third-highest level ever.

China falls off the mining map

Bitcoin hash rates plunged as much as 65% in late June as China intensified its crackdown on mining operations. Bitcoin mining farms and rigs were powered down in anticipation of a great migration out of China and into more welcoming jurisdictions.

According to the University of Cambridge’s (CBECI) Bitcoin mining map, which was updated in August, China no longer contributes to the global bitcoin hash rate. The United States has ursurped its spot as the industry leader in terms of hash rate with 35.4% of the total according to the CBECI.

Kazakhstan is in second place with 18.1% and Russia is the third highest country for hash rate with 11.23%. The exodus out of China has largely been seen as a positive for the decentralization of Bitcoin mining by the crypto community.

However, not all are happy with Uncle Sam taking the mantle due to the regulatory uncertainty and policymaker procrastination with regards to the crypto industry.

Increasing hashrates mean increasing power demands which is a concern for environmentalists. Cambridge reports that the Bitcoin network currently consumes 126.5 terawatt-hours (TWh) per year which is about the same as Ukraine.

This is still way less than the consumption by fridges and lighting in the U.S. alone which is 164 TWh per year — more than the entire annual consumption of Malaysia.

Bitcoin price outlook

BTC prices and hash rates have proven to have little correlation. The asset is currently trading down 3% on the day at $49,200 according to CoinGecko. It’s now down ~30% from its ATH and hopes of a Santa Claus rally are fading.

There is support around the 200-day moving average which lies in the $47,000 region. On the upside, BTC would like need to crack above resistance around $55,000 to continue a bullish rally.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.