Hash rate plays a vital role in every Proof-of-Work (PoW) blockchain. It measures the computational drive for all transaction verification and block additions to the network. Hence, the Bitcoin hash rate represents the number of people involved in BTC mining.

As the number of miners increases, the hash rate will also increase. This results in maintaining the security and stability of the Bitcoin ecosystem. Many investors will consider hash rates before engaging in any project.

Before now, the BTC price and hash rate have maintained a direct proportionality relation. This is because there are always more transactions with the buying and selling BTC when the price is up. With such a price surge, there will be more mining activities to mint more tokens to balance the liquidity.

Related Reading | Bitcoin Weekly RSI Sets Record For Most Oversold In History, What Comes Next?

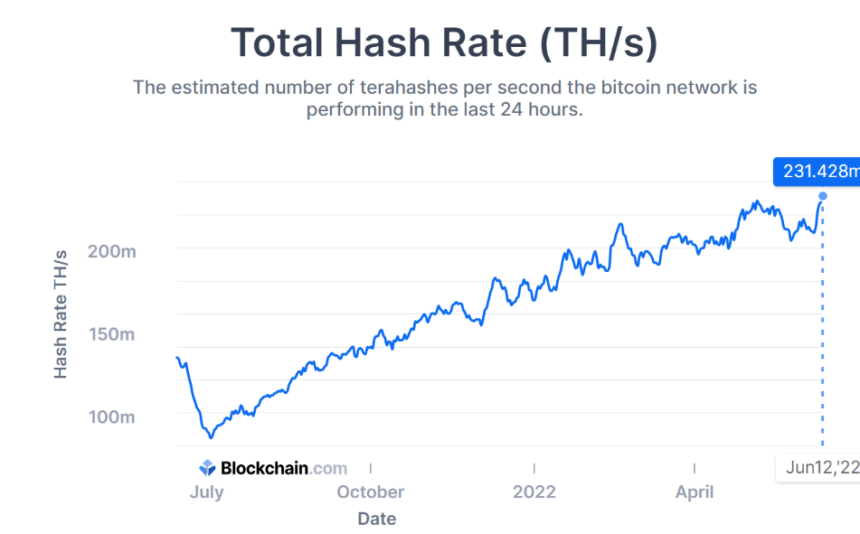

But the recent outturn of events has proved a deviation between the relationship between BTC price and hash rate. Despite the bearish market trend with BTC going below $25,000, its hash rate has drastically risen. Bitcoin hash rate has reportedly grown to a new all-time high of 231.428 ExaHash per second.

The network difficulty of Bitcoin follows similarly with the rise in its hash rate. It has created a formidable stance for BTC in its recent position at 30.283 trillion.

Bitcoin Records More Growth In Different Aspects

The new growth cuts across several BTC mining pools, including AntPool, Poolin, SlushPool, F2Pool, and ViaBTC. The highest part of the hash rate came from miners denoted as OTHERS.

Also, the BTC Lightning Network grew its capacity to 4,000 tokens. This is a network development that inculcates layer-2 (L2) technology. The present increase would facilitate cheaper and faster peer-to-peer (P2P) transactions on the network.

Bitcoin is currently staging more substantial traction for sailing through the general crypto price drop. As the bearish market almost blows off most crypto protocols, Bitcoin is gradually thickening its survival instincts.

The BTC ecosystem’s components collectively create a more favorable and sustainable core. There is consistency in the growing all-time high for its network capacity, hash rate, and network difficulty.

Suggested Reading | Crypto Markets Lose $100 Billion As Bitcoin Drops Below $26K – More Pain Ahead?

The network is also getting backing from developers, miners, and traders. So, the Bitcoin network could get the ranking as the most global secured blockchain. Another implication is that the Bitcoin network is still healthy and functioning correctly. By that, there’s the hope of a rebound from the ongoing bearish trend.

In a new development, TBD, a block subsidiary, has disclosed plans for building Web5. This new development would be a decentralized web solely for Bitcoin. The concept would emphasize the belief of Jack Dorsey, the founder, on getting more influence in internet evolution from BTC.

Featured image from BBC, chart from TradingView.com