Data shows the share of the bitcoin hashrate in control of publicly-listed mining companies has shot up to 19% recently.

Public Mining Companies’ Share Of Bitcoin Hashrate Spikes To 19%

As per the latest weekly report from Arcane Research, the amount of BTC hashrate controlled by publicly-listed companies has observed a sharp increase over the past year.

The “hashrate” is an indicator that measures the total amount of computing power connected to the Bitcoin network.

The distribution of the hashrate can tell us how decentralized the blockchain network currently is. If a large amount of the computing power is owned by a single entity, then the crypto would have lesser decentralization.

On the other hand, a large amount of independent entities controlling the hashrate would make the network more decentralized.

Crypto blockchains with a large degree of decentralization are generally more resilient to malicious attacks on the network.

Today, there are many publicly-traded companies whose main business is owning big Bitcoin mining farms with a large number of miners.

The attraction of these companies’ mining stocks is that they offer an alternative way of getting BTC exposure to traditional investors.

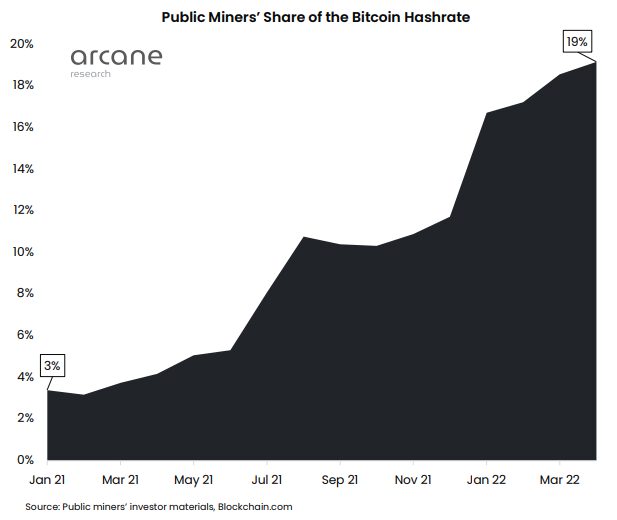

Now, below is a chart that shows how the collective hashrate of these public Bitcoin mining companies has changed since January of last year:

Looks like the value of the metric has observed a rise over the period | Source: Arcane Research's The Weekly Update - Week 13, 2022

As you can see in the above graph, the share of the Bitcoin hashrate controlled by these mining companies was only 3% in Jan 2021.

Since then, the indicator has observed a sharp increase and now stands at around 19%. There are a couple of reasons behind this trend.

Related Reading | Bitcoin Exchange Reserve Takes Further Beating, Now Lowest Since August 2018

Back in Jan 2021, there were only a few public such companies, but today that number has risen to 26. Many private companies went public during this period, and have hence contributed to this upwards trajectory.

Another reason would be that public companies have more access to capital, and so they are able to expand their farms faster than private miners.

While this 19% share is made up by several companies, some of the biggest miners are nonetheless gaining more control of the hashrate.

Related Reading | Latest Trend In Bitcoin Realized Cap Suggests A Bullish Pattern

The report notes that this uptrend will likely continue in the near future, which means the network may continue to get less decentralized with time.

BTC Price

At the time of writing, Bitcoin’s price floats around $45k, down 5% in the past week.

The price of Bitcoin seems to have dwindled down over the past day | Source: BTCUSD on TradingView

Featured image from Unsplash.com, charts from TradingView.com, Arcane Research