After a strong bloodbath earlier this month, Bitcoin and the overall crypto market are showing up some strength as of now. Over the last few hours, Bitcoin has regained its position above $38,000 levels.

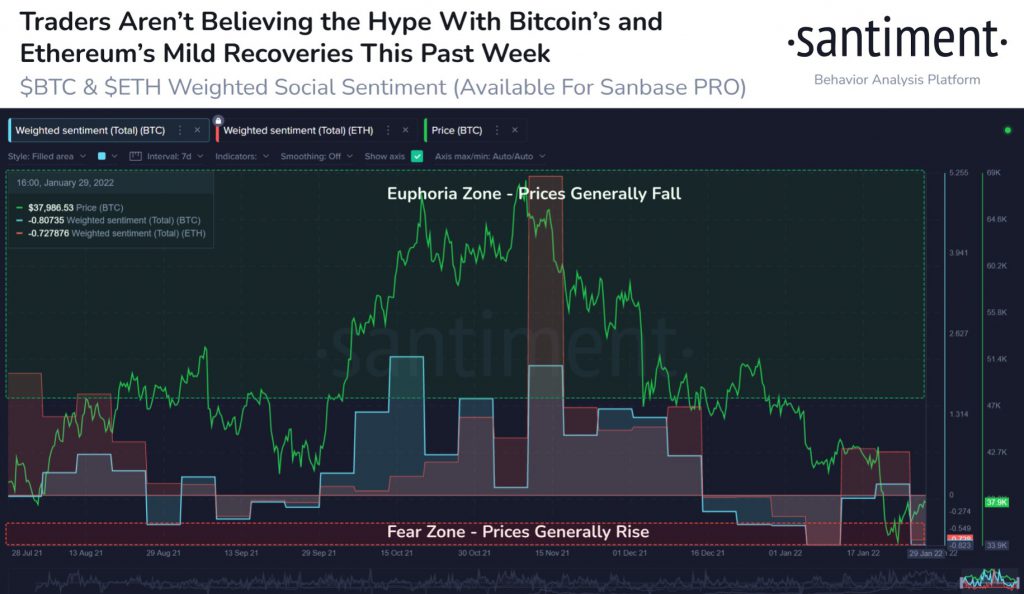

As of press time, BTC is trading 1% up at $38,162 with a market cap of $723 billion. Similarly, Ethereum (ETH) is up trading close to $2600 levels. On-chain data provider Santiment reports that despite the pullback, traders continue to remian skeptical. It adds that this negative sentiment has “a high probability of fueling further price rises”.

Furthermore, another data shows that as the BTC price climbs above the Bitcoin Fear and Greed Index has eased up from levels of “extreme fear” to now “fear”.

Bitcoin Fear and Greed Index is 29 – Fear

Current price: $38,073 pic.twitter.com/JiSM7SgZEC— Bitcoin Fear and Greed Index (@BitcoinFear) January 30, 2022

Instituional players, on the other hand, continue to dominate the Bitcoin on-chain activity. As per Glassnode:

Bitcoin transfer volumes continue to be dominated by institutional size flows, with more than 65% of all transactions being larger than $1M in value. The uptrend in institutional dominance in onchain volumes started around Oct 2020 when prices were around $10k to $11k.

Ethereum, Altcoins To Watch for

On the other hand, the on-chain data provider also reports that Ethereum’s address activity remains at sustained levels despite the early month crash. It notes:

Ethereum has regained the $2,550 level to end the week. With Bitcoin ending the week with a nice push of its own, and $ETH‘s active address remaining stable, the #2 #crypto asset by market cap should maintain stable prices if utility continues rising.

If we look at other altcoins, Chainlink (LINK) is rebounding nicely after correcting a strong 50% earlier this week. As of press time, Chianlink (LINK) is trading 7% up at a price of $17.35 and a market cap of $7.9 billion.

On the other hand, Cardano whale addresses have been loading up their bags amid the recent price correction. Santiment reports: “Cardano’s price, like many #altcoins, have plummeted in the past 10 days, dropping -34%. However, large addresses holding between 10k and 1M $ADA, own 113% more in their collective bags since the drop on January 17th, accumulating $53.6M in tokens”.