Losses leading to heavy discounts on assets are always welcome by crypto traders and investors. This time, however, Bitcoin investors seem to maintain a cautious stance as BTC price continued the struggle below the $20,000 mark.

Volatility is the name of the game in the cryptocurrency space. Another volatility storm was witnessed on Sept. 28 when Bitcoin quickly lost the bullish momentum it had gained over the last couple of days.

After noting a sharp price rise of around 8% on Sept 26 and 27, BTC price saw a pullback to the $18,900 price level overnight.

Recovery or another set of losses – what lay ahead for Bitcoin was still unclear. However, waning social interest and some key on-chain metrics suggest that the retail appetite for BTC has been affected.

So, the top three on-chain indicators that show how BTC accumulation could be slowing down faster than anticipated.

Low on retail investors list

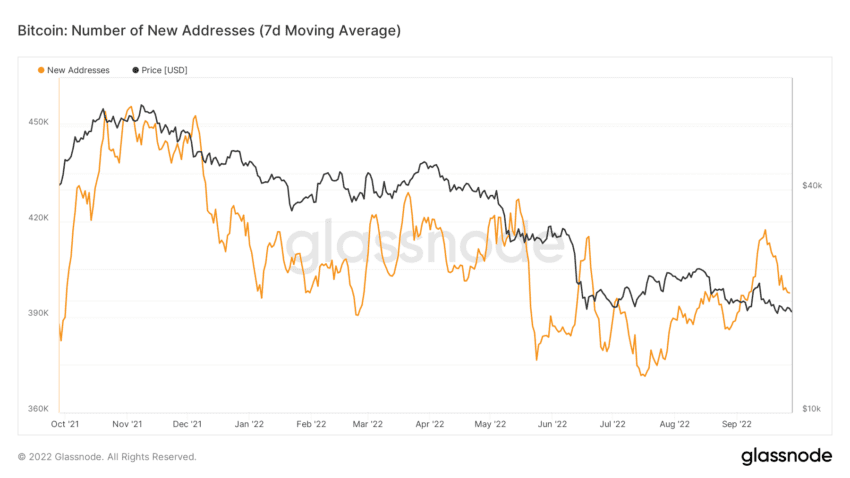

Bitcoin’s rangebound price momentum and bulls’ struggle to keep BTC price above the $20,000 mark have left retailers conscious of their moves. Generally, high trade volumes coupled with new addresses joining the network are indicative of higher retail interest.

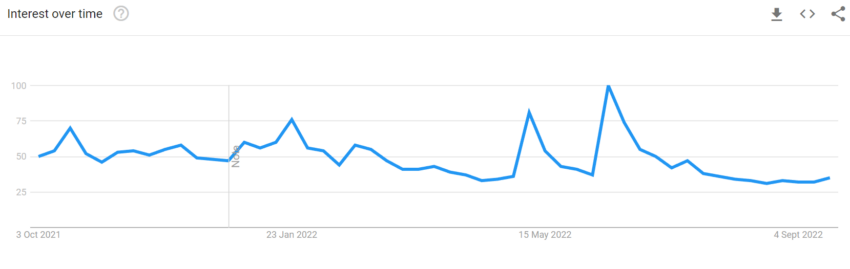

Over the last week, trade volumes haven’t witnessed any significant uptick despite the early-week gains. That said, a continued fall in the Google search trends for Bitcoin also presents a weakening retail interest in the top cryptocurrency.

Retail investors don’t appear interested in scooping up BTC at the low price range of $18,000 – $19,000 as the number of new addresses joining the network daily continues to decline.

Whales and miner HODLing trend lower

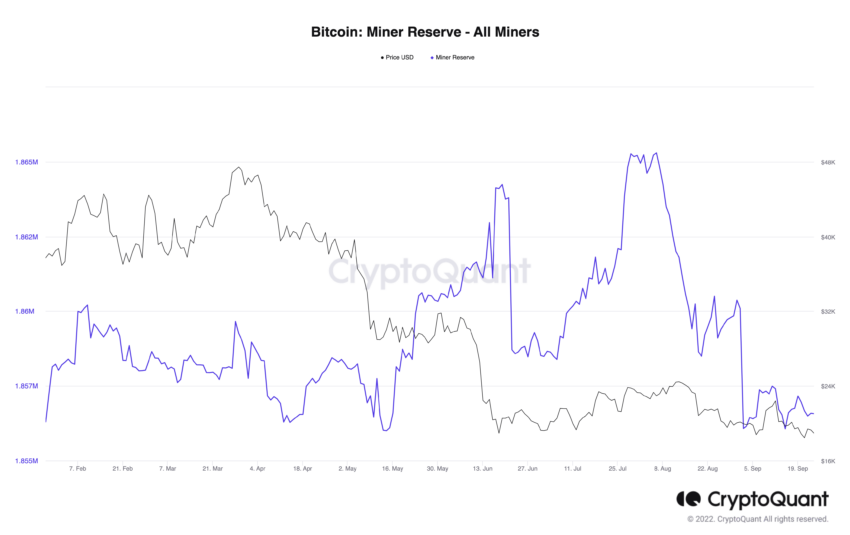

A declining trend in the number of addresses on the network holding more than 1,000 BTC presents how more prominent market players could be losing interest in Bitcoin.

In addition, Miners’ Reserves have remained flat at around 1.86 million throughout September. Miners Reserves noted a sharp decline in August and have failed to recover, barring the occasional upticks.

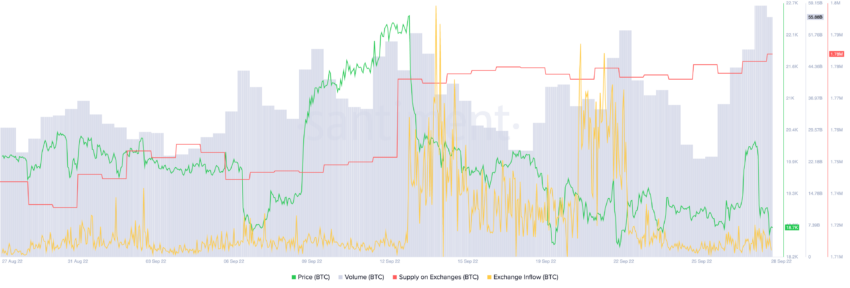

Lastly, the supply on exchanges is trending upwards. Higher inflows to exchanges are indicative of low confidence in the asset.

At press time, with BTC trading at $19,062, the top coin had lost over 6% in the last 24 hours. Seemingly, BTC price is stuck below the stiff resistance above $19,000 as the next solid support sits around $16,200.

In the short-term, a heavy sell-side pressure can pull BTC’s price down to as low as $16,200, where the next long-term support exists.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.