Over the last few years, Bitcoin has emerged as the face of cryptocurrencies among even individuals with /minimal knowledge about crypto. Ergo, Saylor describing Bitcoin as the American Dream raises the question of whether that dream will remain just a dream or become a reality someday.

Bitcoin in the ‘now’

In an interview with Bloomberg recently, Saylor expanded on how Bitcoin compares to real estate properties. In fact, he also touched upon how it is superior to gold in terms of investment. He said,

“If your property is not safe out of your country and it’s not safe in your country, where can you go? The answer is cyberspace. Bitcoin is the American dream.”

Alas, this dream extends beyond just this statement. The king coin hitting $100k was once a dream for investors, leading to the overall adoption of cryptos skyrocketing towards the end of 2021. This was born out of PlanB’s Stock to Flow model as it first pitched BTC at $135k by December end, then cut it down to $100k.

However, PlanB’s prediction failed to turn into reality. In fact, according to some estimates, this pushed the possibility of the same happening by approximately two years.

#BTC is 60% below S2F model value. Some think S2F is dead. Others know we have 2 more years to reach the $100K average. Your choice. pic.twitter.com/xrYeeUN9hP

— PlanB (@100trillionUSD) March 16, 2022

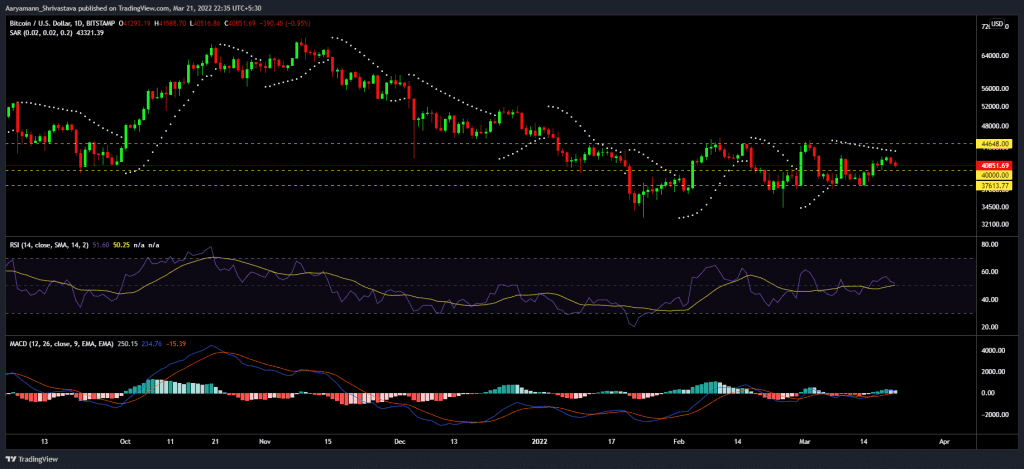

At the same time, the one concern that is a constant roadblock is volatility. Especially since the cryptocurrency has continued to move under the same resistance and support levels for three months now.

Bitcoin Price Action | Source: TradingView – AMBCrypto

However, with inflation rates rising rapidly, some transition towards Bitcoin as a hedge could take place. Only if the rising correlation between Bitcoin and stock markets slows down.

The “Global Dream”

Right now, investors are looking for the best opportunity to enter the market and make the most of their investments. Incidentally, some signals indicate now might just be the best time to do exactly that.

Reserve Risk is currently standing in the most opportune zone for the first time in 12 months, a level wherein investors’ confidence seems high and returns look alluring. Bitcoin entered this zone back in January and has since been lurking there.

Bitcoin Reserve Risk | Source: Glassnode – AMBCrypto

This moment, in particular, is the right opportunity because after slipping into losses again, the P/L ratio shows coins are back in profit.

And, with a gradual incline trend observed on this indicator, it seems like it won’t be long before Bitcoin ceases to fall back down into losses.

Bitcoin Profit/Loss ratio | Source: Glassnode – AMBCrypto

This would drive more investors towards adopting Bitcoin. And maybe, this “American dream” could soon become a “Global Dream.”