“’But how is [Bitcoin] digital energy; how do you get it back to being energy?’ The answer is, I send a billion-dollar block of it to Tokyo, I run it through an exchange … I convert it back into yen and I take the yen and I buy electricity from the Tokyo Power Company.” — Michael Saylor (WBD431)

While I think most Bitcoiners generally agree with the concept of bitcoin as digital energy, I have seen some pushback that this is not consistent with physics, is just a metaphor or is just plain false. I started writing this paper with the intention to argue that all money actually represents a store of energy and bitcoin is simply the best money available. However, I started finding interesting parallels with both love and violence as alternate methods of channeling energy, so I expanded the scope of this paper to offer my thoughts on these areas as well.

First, let’s start with energy. What is energy? According to Britannica:

“Energy, in physics: the capacity for doing work. It may exist in potential, kinetic, thermal, electrical, chemical, nuclear, or other various forms. All forms of energy are associated with motion. For example, any given body has kinetic energy if it is in motion. A tensioned device such as a bow or spring, though at rest, has the potential for creating motion; it contains potential energy because of its configuration.”

When it comes to what things humans typically think of as energy, there is certainly something to say for our ability to control or direct that energy. Before electrical applications were invented, electricity was probably not commonly thought of as a form of energy. Thus, the energy conversion device is perhaps just as important as the energy itself.

Modern humans have invented devices that allow us to use and scale all sorts of different types of energy. However, our original energy conversion device was, of course, the ability of the human body to convert the chemical energy in our food into kinetic energy that we inherently control. Today, despite having access to other sources of energy that have scaled immensely, human energy remains extremely valuable.

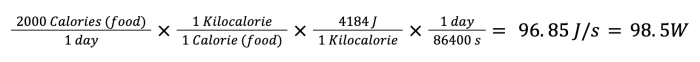

Despite our rather limited energy output, humans have evolved to be wildly efficient. With the assumption that an adult human worker uses 2,000 calories (food) per day, we can calculate the rate at which we can control our own energy:

At a rate of 98.5W, a human who works 40 hours per week, performs approximately 200 kWh of work for their employer in one year. In comparison to electrical energy conversion devices, this is an exceedingly minuscule amount of work. However, if this human has an annual salary of $50,000, the value of their energy output would be $250/kWh. The extremely high value of human energy is largely due to our ability to learn, adapt, engineer solutions and harness other forms of energy to provide valuable solutions to society.

Note, however, that the energy delivered by each human is exclusively controlled by the individual. I am the only person who can choose to raise or lower my arm; therefore, I am the only person who has control over the actions of my chemical energy conversion device (body). Because of this, humanity is continuously looking for answers to the question: “How do we convince other humans to channel their energy to a specific application?”

Our species has discovered many ways to motivate humans to channel their energy toward a specific task. In this article I will be discussing the following three broad categories:

- Love (family, friends, God)

- Violence (force, threats, war)

- Money (barter, metals, fiat, bitcoin)

Love

Love has evolved as part of human society and is the reason that parents choose to use their energy to meet the needs of their children. Love generally maximizes the efficiency of human energy because people who are motivated to cooperate via love genuinely want their work to achieve the best possible outcome. Love is a voluntary, decentralized means of channeling human energy. Each member of society can choose to love or not love another human; love cannot be forced.

However, love is very challenging to scale. One possible reason for this could be related to Dunbar’s number, which is a suggested cognitive limit to the number of people with whom one can maintain stable social relationships. Personally, I believe that connection to God allows humans to scale love beyond Dunbar’s number, however, I will reserve my thoughts on this topic for another time.

Violence

Violence, or the threat of violence, can also be used to channel human energy. Controlling energy through violence has its roots in the evolution of life on this planet. One attribute of violence that has made it such an effective means of forcing human cooperation is that violence scales. Specifically, violence can be scaled by engineering weapons that leverage human energy or incorporate more powerful forms of energy, i.e., gun powder, fission, fusion, etc. In addition, unlike love, violence can be stored and stockpiled for future use, offering the ability to scale the threat of violence as a means of channeling human energy.

However, violence is a non-voluntary, centralized solution to scale cooperation. Violence centralizes power because it favors those with the most powerful weapons, which grants them access to the most human energy and innovation, which enhances their ability to engineer even more powerful weapons. This centralization has led to non-optimal outcomes for humanity as a whole and is generally an inefficient means of directing human energy. Forced labor will never be as efficient as voluntary labor, and centralized decision making will never be better than decentralized decision making.

Money

Which brings us to money. The invention of money allowed humans to scale cooperation beyond Dunbar’s number without the need for love or violence. Money motivates humans to use their energy toward someone else’s goals by promising them that the money they were paid for their work can be used in the future to deploy the energy of other humans. Similar to violence, money can also be stored and stockpiled for future use. Money is a battery for human energy; the battery is charged as you work for someone else, and is discharged as someone else works for you. Money, therefore, represents stored human energy.

Unlike violence, money allowed for systems of decentralized decision-making to develop. Money enabled economies to emerge where humans all voluntarily participate in determining the value of different forms of labor. Decisions about what a society needs could therefore be set by the market, where each human decides what they are willing to pay for a good or service. In comparison to violence, money is a significantly more efficient scaling solution for motivating humans to channel their work toward a specific goal.

However, all forms of money can be corrupted through violence. Money, like life, can be stolen using violence. Decentralized markets can become centralized when violence, or the threat of violence, is used to control human actions. In earlier societies, when governments wanted to use violence to accumulate wealth, they needed to physically take the money from their citizens or from other external entities. Largely after the invention of nuclear weapons, when the threat of violence and the cost of war started reaching unimaginably enormous magnitudes, governments started relying on money printing more heavily to continue acquiring wealth. Paper money that can be printed radically changed the scale at which governments could acquire and deploy money. Increasing the number of monetary units devalues all of the existing money in a given economy and transfers that value to the entity in control of the money supply.

Note, however, that the amount of work that can be done with this stolen value will decay over time due to price inflation. As the newly printed money enters an economy, the decentralized market pricing mechanisms will take the new supply of money into account and raise all prices relative to how much individuals value their own human energy. Forcing the participants in an economy to reprice goods and services on a continuous basis also offers the opportunity to influence the value each human places on their own labor. Depressing a population, for example, may lead to participants ascribing less value to their own work and will result in lower relative repricing of goods and services after an inflationary event. When wages don’t keep up with price inflation, this can be viewed as a signal that market participants are attributing less value to the deployment of their own energy.

Although governments may earn money through taxation by providing services determined to be valuable by their citizens, i.e., protecting physical property rights, the majority of monetary energy controlled by modern governments is stolen primarily using the threat of violence to maintain their control over the money printer.

Enter Bitcoin

Users of bitcoin — like users of all other forms of money — can be subjected to violence, or the threat of violence, as a means of forcibly acquiring their wealth. However, the violence needed to forcibly acquire bitcoin from an individual who controls their own private keys must be applied with extreme precision. Neither bullets nor weapons of mass destruction are effective methods of violence for stealing bitcoin. I would argue that the forms of violence required to forcibly acquire bitcoin don’t scale at all in comparison to traditional violence. Therefore, bitcoin is strongly resistant to theft via violence.

It is also not possible for bitcoin’s value to be stolen via supply inflation. Although the supply of bitcoin in circulation is increasing over time (albeit at an exponentially decreasing rate), the inflation rate is public knowledge and can be accounted for when pricing goods and services. Further, there is 100% market consensus on what bitcoin’s supply inflation will be used for. Newly-minted units of bitcoin are exclusively used to subsidize payments to bitcoin miners for the security and transaction processing services they provide.

During the early stages of bitcoin’s existence as money, all bitcoin holders contribute to Bitcoin’s security and transaction processing budget via an exponentially decreasing inflation tax. Currently, about 98% of miner revenue is supplied by Bitcoin’s 1.74% annual inflation rate, i.e., block reward, which will be cut in half approximately every four years. In the future, Bitcoin’s security budget will be paid for entirely by market participants who transact over the Bitcoin network, i.e., transaction fees. The block reward is therefore a temporary measure designed to subsidize security while Bitcoin is still in its youth; it would be more accurate to view this form of taxation as a collective payment for a valuable service, rather than theft.

In conclusion, humans have invented all sorts of energy conversion devices to accomplish our goals. However, humans remain one of the most efficient, flexible and valuable sources of energy conversion available. Therefore, controlling the flow of human-supplied energy remains a fixture of human civilization. Although each human controls their own energy, we can be motivated using methods such as love, violence and money to work together.

Historically, love has failed to scale in comparison to violence and money. Although violence has proven to scale, it is inefficient and does not optimally orient human progress due to centralization of power and decision-making. Although money offers a more efficient scaling solution for channeling human energy, it has historically been susceptible to violence at scale and fiat based monetary units can be stolen via inflation. Bitcoin is a new form of money that cannot be forcibly acquired using violence at scale and cannot be stolen through inflation.

Bitcoin represents an opportunity to protect money from the influence of violence, abolish inflation without consensus and restore high quality decentralized market signals. It will take time for society to realize these benefits as bitcoin is still young in comparison to other forms of money and is not currently widely adopted across humanity. If more people start to understand that money represents human energy, I believe humanity will start to demand better money, and when they do, bitcoin will be here for them.

This is a guest post by Freedom Money. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.