Keen Bitcoin [BTC] traders may have noticed that BTC volatility was down by a considerable level. Not so long ago, BTC would make major moves where prices would rally by huge margins, making it quite profitable for long-term holders. Fast forward to the present: Being a long-term BTC holder is not as profitable.

A recent Glassnode analysis summed up BTC’s declining long-term holder profitability. According to the analysis, long-term holder profitability was down to levels previously seen in December 2018.

This was around the same time that the market bottomed out during the previous bearish cycle. The report also claimed that long-term holders were selling at a 42% average loss according to the long-term holder SOPR metric.

#Bitcoin Long-Term Holder profitability has declined to levels last seen during the depths of the Dec 2018 bear market.

Long-Term Holders are selling $BTC at an avg loss of 42%, indicating LTH spent coins have a cost basis around $32k.

Live Chart: https://t.co/sCKIzBLCTM pic.twitter.com/wEnfVzEs9I

— glassnode (@glassnode) September 29, 2022

The assessment coincided with BTC’s performance, especially in the last three months. The cryptocurrency has struggled to recover from the lower range, and price levels above $25,000 have now become a past narrative. BTC’s latest performance also indicated more affinity for price levels below $20,000.

Furthermore, BTC’s current range might explain why long-term holders are opting to shift from a long-term strategy. The cryptocurrency, so far, maintained a healthy level of volatility in its current range.

Long-term investors have thus, been opting out of their positions to avoid missing out on short-term gains.

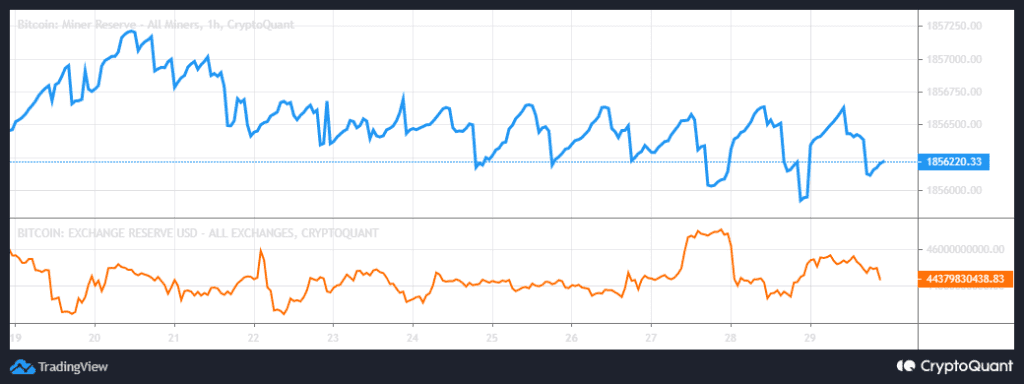

BTC miners are among those affected by the shift from long-term to short-term profits. They have traditionally waited for prices to go high so they can take larger profits but that is not the case anymore. Miner reserves were caught up in a loop of the short-term selloffs, especially in the last few weeks.

The pressure on miner reserves resulted in an overall drop, especially in the last 10 days. An interesting dynamic between miner reserves and exchange reserves was also observed.

Exchange reserves have increased on multiple occasions when miner reserves dropped, thus creating an inverse relationship. This is because the market has been treating miner reserve outflows as a signal to sell.

The larger picture

Lately, miner reserves have also been heavily influenced by the need for miners to cover the costs of mining. They are thus, forced to sell at times regardless of BTC’s surge or drop. Macro factors also come into play as far as BTC’s price action is concerned.

Economic factors such as inflation also have a massive impact on investment decisions. For example, the market conditions that prevailed in the last few months resulted in a shift from risk-on to risk-off assets.

The effects of inflation have forced many traders to get out of BTC and other risk-on assets and many have been holding the dollar instead. This further explains why the dollar has been growing stronger.

It may take months to get inflation in check, and this may affect BTC’s ability to recover back to its previous highs. The upside to this situation is that the drop in long-term investor profitability to 2018 levels might signify that the market is near the bottom of the current bearish cycle.