Bitcoin has seen wide-ranging fluctuations in 2022 as it dropped massively during this bear market. One aspect that has appreciated in significance lately is the sentiment of long-term holders. The selling pressure on LTHs has reduced as prices rallied throughout July above their average cost basis – $22.6k.

However, despite the lowering of financial constraints, LTHs continue to sell at net losses tucked in between 11% and 61% on average. Could this selling pressure fuel unwarranted FUD in market sentiment as it attempts recovery?

Gather the crowd

Despite uncertainties in the macro landscape, the crypto-market has been gradually recovering since early July. Bitcoin itself has overseen a steady growth over this period as it briefly touched the $24k-level. However, concerns are emerging after the most recent episode of selling pressure from the long-term holder cohort, as reported by Glassnode.

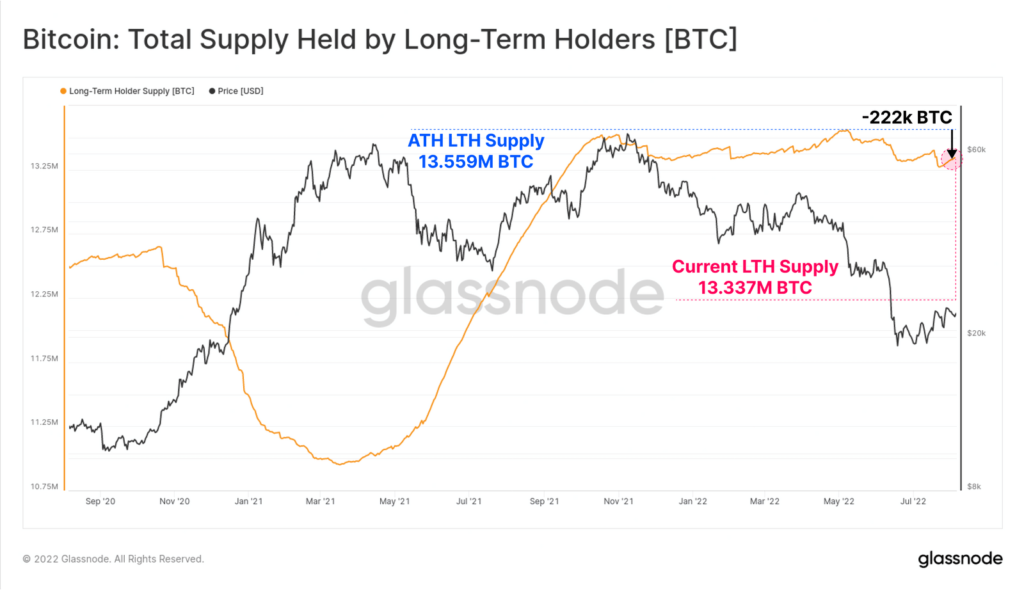

Right now, Bitcoin long-term holders are in possession of over 13.337 million BTCs, 79.85% of the total circulating supply. However, since the start of May, they have distributed around 222k BTC – Equivalent to approximately 1.6% of their all-time-high holdings.

The LTH-cost basis was trading at $22.6k, at press time, meaning that on average the long-term holdings are at 4% profit. This, because BTC was trading just below $23.2k, at the time of writing. This would mean that the press time MVRV ratio represented profitability for these long-term holders.

There has also been a significant change in the market sentiment of long-term holders over the past three weeks. Their aggregated behavior has changed from accumulating at a rate of 79 BTC/month to distributing up to 47k BTC/month.

As pointed out in the report,

“Remarkably, this cohort seized the opportunity of rallying prices and spent 41k BTC, or 0.3% of their supply, over the last 21 days. (Note that net spending is defined as Accumulation plus HODLing minus Distribution).”

“Bitcoin to the moon”

Santiment also pointed out an interesting development on social media among Bitcoin enthusiasts. Bitcoiners echoed their sarcastic chants of “moon” and “lambo” on social media during the crypto-slide this year.

However, spikes in these words are often the signs of a bullish BTC rally.

Conclusion

Institutional sell-offs have also been pointed out in the news lately. The most famous of which was Tesla selling over 75% of its BTC holdings recently.

While these indicators look to fuel FUD sentiment in the market, BTC continues to maintain its support level. Bitcoin has remained relatively unchanged over the last 24 hours, but was down over 2.8% over the week.