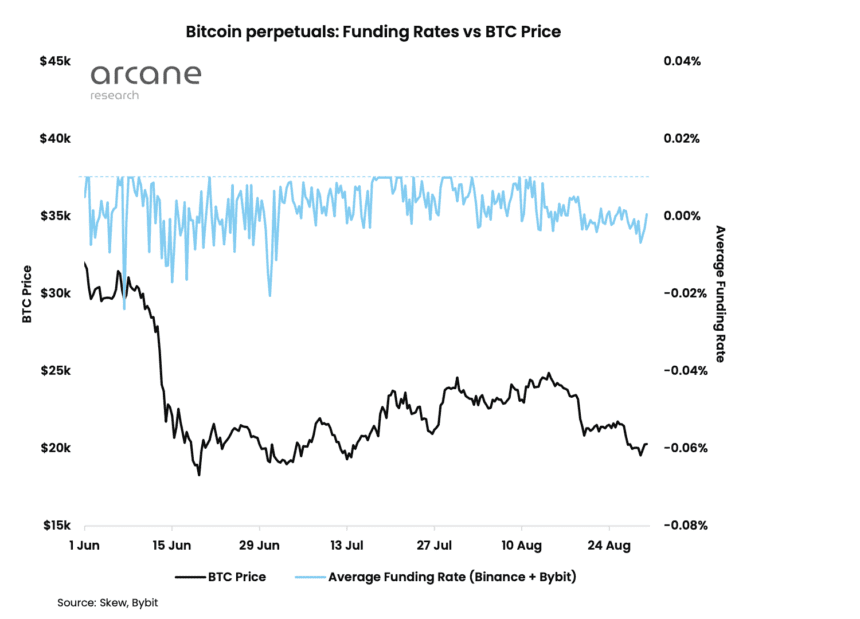

Bitcoin funding rates for the past two months have entered one of their worst streaks yet. During this time, there have been no positive funding rates, and the best that the market has seen has been funding rates at a neutral level. However, even now, reaching neutral levels have proved incredibly hard for funding rates, taking a deeper dive with each passing week.

Funding Rates Remain Below Neutral

The last time bitcoin funding rates had been in the neutral territory had been at the beginning of August. Since then, funding rates have consistently returned below neutral, with some short-term lows being recorded along the way. Funding rates on crypto exchange Binance have actually dropped to 2-month lows at this point. Additionally, the crypto exchange has now hit nine months of funding rates at or below neutral levels.

This puts the perpetual swaps at a continuously lower rate compared to spot market prices. Bitcoin traders have since been reducing their risk exposure to the digital asset, and this has come as a culmination of such wariness.

Funding rates remain below neutral | Source: Arcane Research

It is the most bearish that the market has been since the bull market was triggered in 2020. This even comes despite the fact that bitcoin open interest has been seeing higher levels. On Tuesday, the bitcoin funding rates sat at around 0.00% and had touched a 2-month low earlier in the week.

Bitcoin Open Interest Grows

Bitcoin open interest has maintained a consistent growth rate despite the funding rates taking a nosedive at each possible point. Each week has seen open interest either hit a new all-time high or come close to reaching it. The former was the case last week.

BTC trading below $20,000 | Source: BTCUSD on TradingView.com

This time around, open interest had a brand new all-time high of 398,075 BTC on August 29th. This is more than 2% of the total BTC circulating supply. It is up significantly from its lowest point last year of 186,158 BTC, representing a more than 110% growth in this time.

With the open interest so high and funding rates so low, it leaves room for the possibility of a short squeeze. This unusual market has not been ignored by investors, leading them to take up more conservative positions.

Bitcoin’s price has also not been encouraging. After hitting a new local high of $25,000 about a week ago, the digital asset is now struggling to hold above $20,000.

Featured image from RushRadar, charts from Arcane Research and TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…