Ever since the all-time high of $67.5k, Bitcoin has kept its movement restrained negatively. Recoveries had been slow throughout December and overall PlanB’s plan of Bitcoin reaching $100k by December was turned into a joke.

By the looks of it maybe even for the beginning of 2022, the king coin will keep this momentum going despite the on-chain indications.

Bitcoin – In demand | Bullishness – Not so much

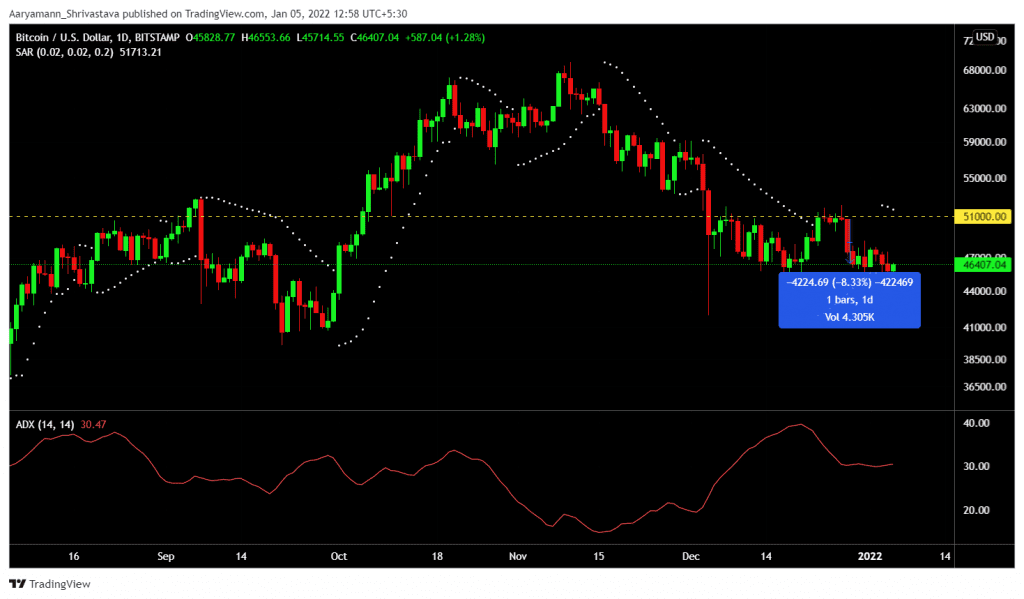

As we step into 2022, some speculation for a bullish or corrective momentum was speculated. However, following the 8.3% price fall of 28 December, prices have only been treading downwards.

Bitcoin price action | Source: TradingView – AMBCrypto

And yet somehow, investors have been unfazed when it comes to their bullishness towards acquiring BTC despite the actual macro bearishness.

Looking at Liveliness we can observe that for pretty much the better half of 2021, the indicator has been following a strong downtrend. This reflects the relative growth of coin days created to the coin days destroyed.

Thus even as prices correct the increasing dormancy and/or HODLing observed is not truly surprising since investors are looking to accumulate as much as possible right now, at the lowest possible price.

Bitcoin liveliness | Source: Glassnode – AMBCrypto

This is also why we are seeing more and more Bitcoin turning illiquid. Investors are acquiring BTC but are refraining from selling them in the hopes of a rally.

In the last month alone over 50k BTC, worth $2.3 billion attained the status of illiquid i.e. sitting in a wallet that hasn’t seen transactions in a while. Basically indicating that this is the result of a broader accumulation sentiment.

Bitcoin illiquid supply | Source: Glassnode

Unfortunately, their bullishness towards demand may not be able to help Bitcoin’s price as the larger investor sentiment continues to remain negative.

Bitcoin investor sentiment | Source: Santiment – AMBCrypto

The reason behind this could also be the persisting fear that began almost a month ago.

Fear continues to dominate the market | Source: Alternative

Additionally ADX’s indication of the increasing strength of the active trend – downtrend, also refutes the possibility of a recovery in the near future (ref. Bitcoin price action image).

The resistance level of $51k once again stands as the critical and psychological test of bullishness. Crossing it would provide Bitcoin the strength needed to rally further ahead, until then its best that Bitcoin bulls manage expectations and keep $100k out of their minds for a while.