Bitcoin, at one point, was considered a hedge against inflation since the value of the U.S Dollar kept declining. However, with time, the king coin’s correlation with the stock index has kept on growing. As a result, today, Bitcoin has fallen to its lowest point in almost 20 months.

Bitcoin needs CPR

The last time Bitcoin capitulated was back in March 2020. This was when the Covid-19 pandemic brought the world to a standstill. Now, while the market did recover soon after, another such episode within years of that one wasn’t exactly expected.

The political and economic condition of the world has continued to degrade over the last 365 days. Consequently, owing to a correlation of 0.6, BTC has suffered as well.

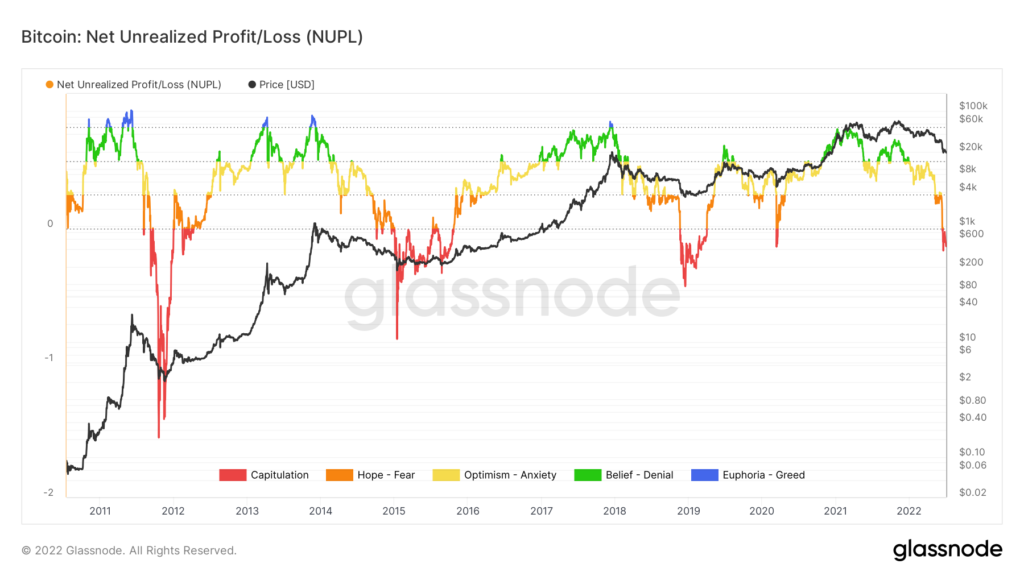

Bitcoin net unrealized losses | Source: Glassnode – AMBCrypto

As highlighted last week by AMBCrypto, miners had already begun exhibiting signs of capitulation. Now, investors too have entered the same arena.

Metrics across the board seem to highlight some capitulation for Bitcoin. Here, metrics such as the Spent Output Profit Ratio and Net realized profit/loss are worth looking at.

Bitcoin net realized losses | Source: Glassnode – AMBCrypto

Even so, in the last month alone, Bitcoin has witnessed the most significant depletion of tokens in the asset’s history. While it may sound like investors are gearing up for a price increase born out of desperate optimism, the sudden withdrawal could be due to investors’ waning faith in centralized entities.

Thus, taking self-custody of their assets could be a route much more favorable to Bitcoin holders.

Bitcoin exchange net position change | Source: Glassnode – AMBCrypto

Going forward, the path of Bitcoin’s price action will be determined not by the crypto-market, but by the stock market.

Consider this – Historically, the second halves of years with the five worst first six months have seen varied growth, but some growth nonetheless.

In 1932, after a 43.48% contraction, the market improved by 42.98% in Q4. The last time this happened was in 1970 when after a 21% contraction, the market recovered by 26.72%.

This year, between January and June, the S&P 500 Index registered a 20.58% decline. A recovery of this scale would place Bitcoin back at $46k, at the very least.

Worth noting, however, that this is predicated on the market not deteriorating further.