In this article, BeInCrypto analyzes the behavior of different Bitcoin (BTC) wallet sizes, in order to determine which are increasing or decreasing their positions.

Number of BTC addresses

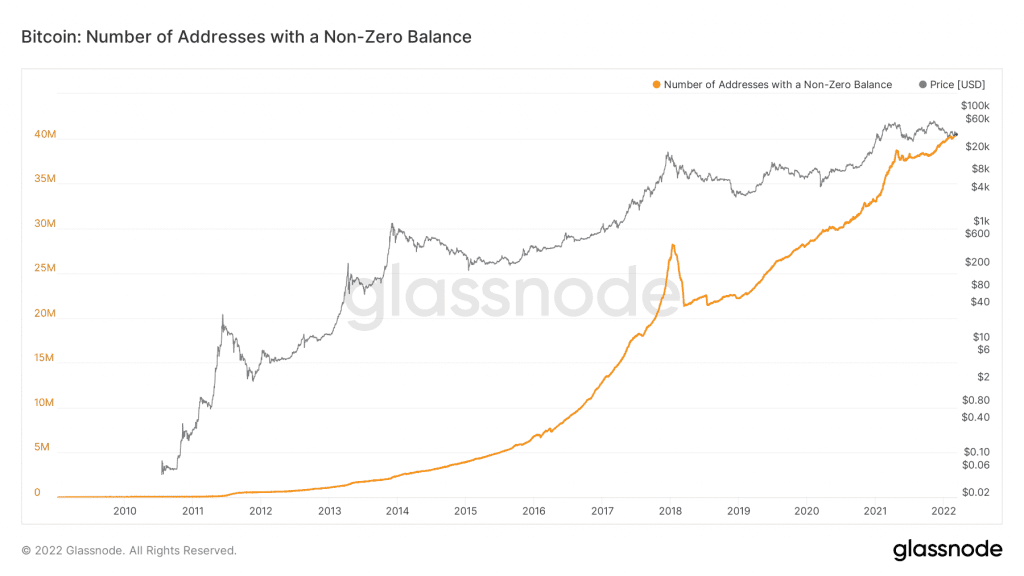

The total number of non-zero BTC addresses has been increasing since March 2018 after the sharp sell-off that began in December 2018. This sell-off accelerated in March 2019 at the beginning of the current bull run.

Initially, the number of new addresses dipped slightly in April 2021 when BTC reached a local top.

However, after the drop, it resumed its ascent and reached a new all-time high of 9,663,021 on March 15.

Therefore, despite the ongoing market correction, the interest in BTC is at an all-time high.

Small addresses

Addresses holding between 0.01 BTC and 1 BTC have shown a very constant increase over the past two years.

Although these numbers dipped during June/July 2021, they have regained their footing since and are increasing toward a new all-time high.

Therefore, small accounts appear to be gradually accumulating.

Medium holding addresses

Unlike small accounts, medium-sized accounts are showing a gradual decrease since 2017. This is visible in both addresses with more than 10 BTC (red) and more than 100 BTC (gold).

Medium-sized holders have yet to reach a new all-time high.

Large holding addresses

Despite the decrease in medium-sized addresses, the number of addresses with more than 1,000 BTC and more than 10,000 BTC has been varying wildly.

While neither is at an all-time high, both have been moving upwards in 2022.

In the case of addresses with more than 10,000 BTC (yellow), the bulk of the increase occurred in September 2021 (black circle).

In the case of those with more than 1,000 BTC (red), the majority of the increases occurred at the beginning of March 2022(red circle).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.