All good things must come to an end as Glassnode, in a new report, found that volatility returned to the Bitcoin [BTC] market last week. According to the blockchain analytics platform, the leading coin, at press time, traded in a period of historically low volatility. Additionally, many on-chain and off-chain metrics hint at an imminent period of “elevated volatility” for the king coin.

Before last week, the BTC market had been marked by an uncharacteristically low degree of price volatility. This was in sharp contrast to the broader financial markets (equity, credit, and forex markets) which have been significantly unstable.

According to Glassnode, if historical precedents in bear markets are anything to go by, with the current volatility in the market, the price per BTC might move in any direction when the volatility calms.

Brace for impact!

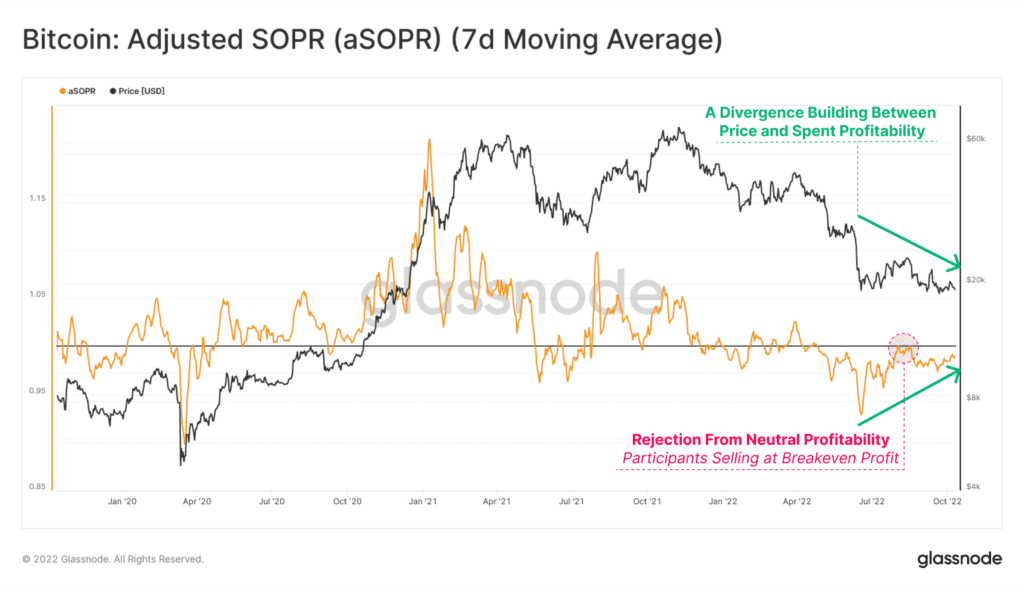

Glassnode also found a significant divergence between BTC’s price action and its Adjusted Spent Output Profit Ratio (aSOPR). For context, when the metric is precisely one in a bullish trend, it often acts as a support as buyers tend to buy the dip. Conversely, when aSOPR equals one in a bear market, it acts as resistance as investors scamper for any available exit liquidity.

In the current market, a divergence price/aSOPR divergence was underway. As BTC’s price declines, the volume of losses recorded would also decline. This would indicate sellers’ exhaustion within the current price range, Glassnode found.

With the weekly average of aSOPR approaching the break-even value of 1.0 from below, Glassnode opined,

“it is increasingly likely that volatility is on the horizon, either as a breakout or yet another rejection.”

Furthermore, Glassnode considered the aSOPR metric by the constituent investor cohorts. It looked at the contributions of BTC Short-term holders (STHs) and Long-term holders (LTHs) and found a similarity. Glassnode found that the current situation was identical to the bear BTC bear markets between 2015 to 2016 and 2018 to 2019.

For STH holders, when the price/aSOPR divergence occurred in the 2015-2016 bear market, buyers bought the dip instead of the anticipated panic selling. However, when the same reoccurred in the 2018-2019 bear market, sellers exceeded buyers, and many wanted out of the market.

In the current market, Glassnode found that the STH-SOPR once again approached the break-even threshold. This usually precedes a period of severe volatility in the BTC market.

For long-term holders of BTC, Glassnode discovered that their spent profitability continued to “languish at historical lows.” Per the report, such period of lows typically occurs “towards the depths of the bear market with only 3.3% of trading days incurring higher losses.”

Options and futures

Lastly, BTC Options and Futures markets have not been excluded from general market volatility. As for the Options market, Options pricing of short-term implied volatility (IV) reached an all-time low of 48% last week.

Likewise, trading volume also witnessed a decline to multi-year lows of $24 billion per day in the Futures market. This, according to Glassnode, was last seen in December 2020.