Bitcoin (BTC) bounced off what is for some a key level on Jan. 9, closely mimicking events from September 2021.

“Shorters will get rekt” at $40,700

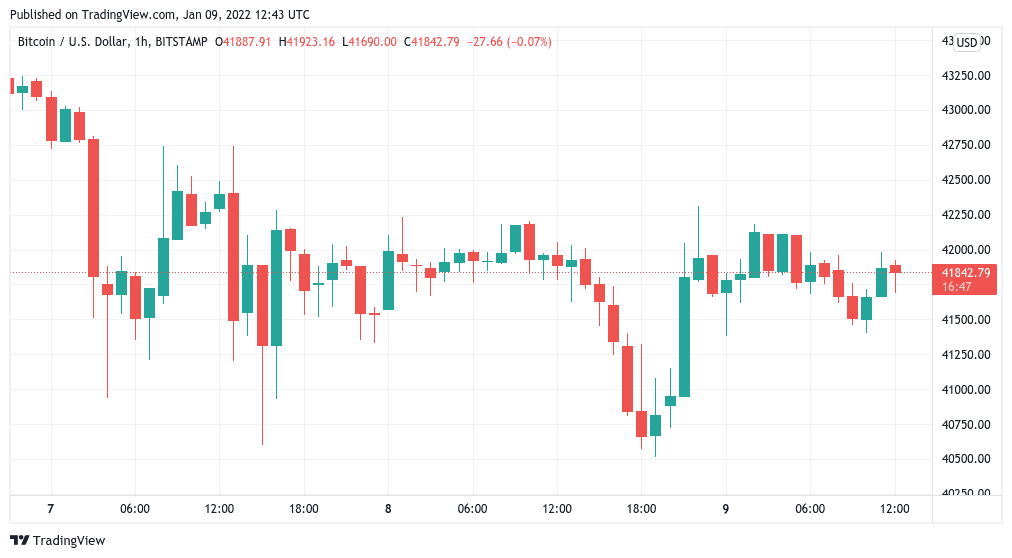

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reversing course at around $40,700 to subsequently pass $42,000.

The behavior, while uninspiring for some, firmly reminded others of Bitcoin price behavior at the end of September, when $40,700 acted as a springboard which ultimately produced $69,000 all-time highs seven weeks later.

History and Context

40.7k $BTC https://t.co/LqlkxxJ0BF pic.twitter.com/neJlH6mnmN— Pentoshi DM’S ARE SCAMS (@Pentosh1) January 8, 2022

“Months have passed since September. And yet, BTC finds itself in the same situation, macro-wise,” trader and analyst Rekt Capital commented.

“Still consolidating inside its macro Re-Accumulation range. In fact, $BTC is almost at the very same price point at which BTC bottomed on the September retrace.”

Macro commentaries regarding stricter economic policy from the United States Federal Reserve meanwhile continued.

As last week, concerns focused on crypto markets’ ability to thrive in an atmosphere without the extent of “easy money” availability, which has characterized the economy since March 2020.

“Crypto diehards about to find out if it really was bubble: Rock-bottom rates & trillions of dollars in CenBank money & govt stimmy helped turbocharge prices of digital assets,” markets pundit Holger Zschaepitz argued in a recent Twitter post.

“Can mkt hold up w/o them? Bitcoin on course $40k w/flat CenBank balance sheets.”

What difference a year makes

Further similarities came in the form of BTC/USD exactly matching its position from the same day one year ago Saturday. A key difference, however, lay in sentiment.

Related: Will this time be different? Bitcoin eyes drop to $35K as BTC price paints ‘death cross’

On January 8, 2021, the Crypto Fear & Greed Index stood at 93/100, flashing a warning that a local top should soon arrive and that the market had entered “extreme greed.”

By contrast, this Saturday scored just 10/100 — one of the Index’s lowest-ever readings deep within “extreme fear” territory.

“BTC Bulls are getting fearful. BTC Bears are getting greedy. Food for thought,” Rekt Capital added.