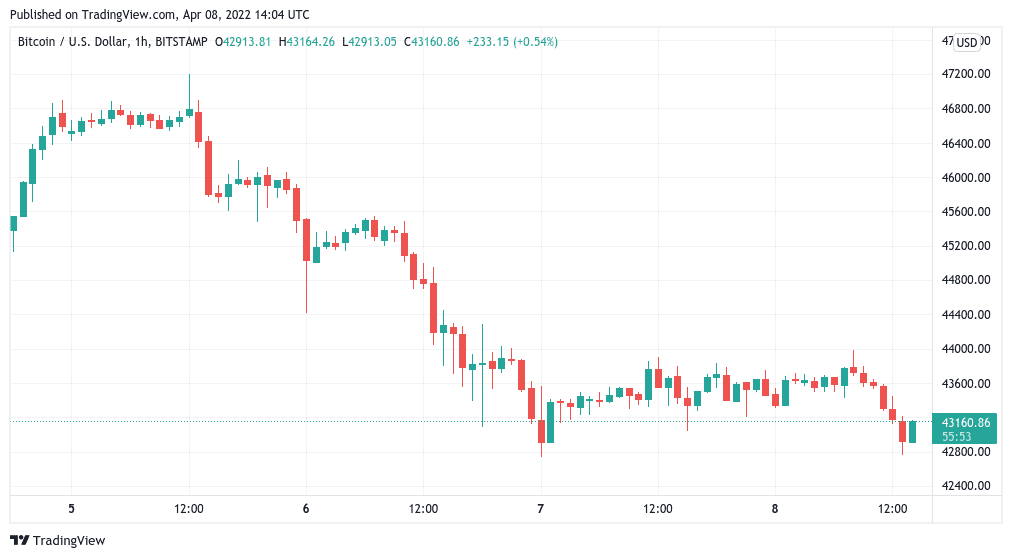

Bitcoin (BTC) neared new price lows for April on April 8’s Wall Street open amid a fresh surge in the U.S. dollar.

$43,000 hangs in the balance

Data from Cointelegraph Markets Pro and TradingView captured another day of gloom for BTC bulls as the largest cryptocurrency slipped back under $43,000.

In a classic move, BTC/USD reacted unfavorably to a resurgent dollar, with the U.S. dollar currency index (DXY) returning above 100 for the first time since May 2020.

Coming on the back of tightening measures from the Federal Reserve, the greenback also spelled a headache for stocks, which opened down on the day.

While some considered the DXY event a temporary show of strength, its impact on crypto markets was clear to see, exacerbating an already wavering recovery from months of downside.

Huge risk-off shift in TradFi in the last few hours… Dollar index >100 for the first time since May 2020

US equities puking in pre-hours… crypto down, but not as much as it should be all things considered

— tedtalksmacro (@tedtalksmacro) April 8, 2022

“Now the bullish chart is getting confirmation, which tells me we are closer to the end of this bull leg on DXY,” popular analyst Aksel Kibar told Twitter followers as a part of his comments.

For Cointelegraph contributor Michaël van de Poppe, the area between spot price and $40,000 was crucial to hold to preserve Bitcoin’s uptrend.

#Bitcoin approaching crucial level to test if it wants to continue moving upwards, to potentially $56K. pic.twitter.com/pip6E4qoWE

— Michaël van de Poppe (@CryptoMichNL) April 8, 2022

Beyond the dollar, Bitcoin was also struggling against another resurgent currency just weeks after hitting all-time highs against it.

The Russian ruble, fresh off record lows against all major world currencies, returned with a vengeance over the week, on April 8 beating its 2022 best in USD terms.

BTC/RUB traded at 3.46 million at the time of writing, its lowest since Feb. 27 and 34% below its record.

LUNA brings up the rear on major altcoins

On altcoins, Ether (ETH) was a rare island of calm on the day as many of the top ten cryptocurrencies by market cap showed signs of strain.

Related: Bitcoin trader eyes $38K dip as Cathie Wood confirms $1M BTC price target by 2030

ETH/USD traded flat at $3,220, limiting weekly losses after some impressive levels were reclaimed.

A notable weak performer on the daily chart was Terra (LUNA), down 6% at the time of writing, despite the buzz behind its issuer’s stablecoin backing plans.

Near Protocol (NEAR), also planning to release an algorithmic stablecoin, meanwhile saw considerable upside over the past 24 hours after raising $350 million.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.