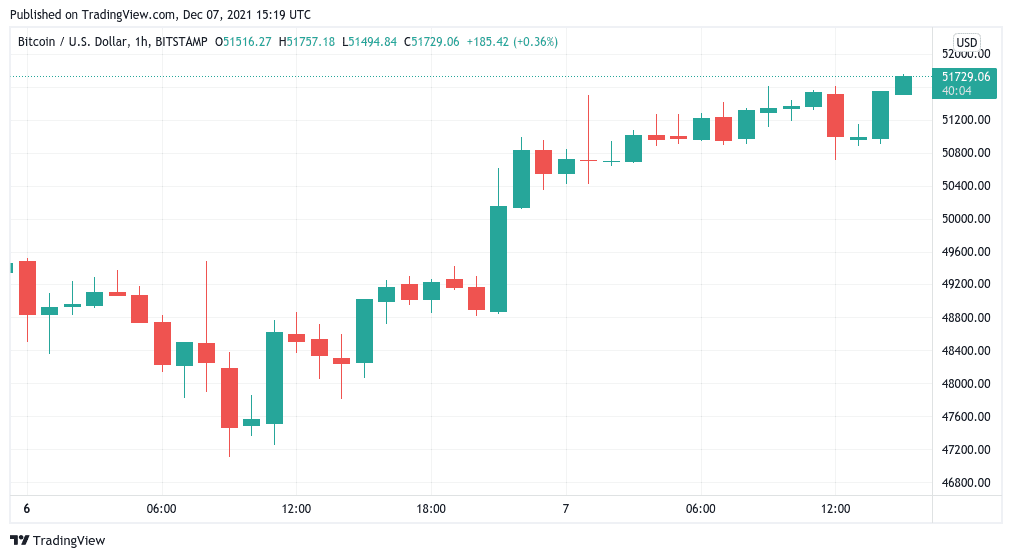

Bitcoin (BTC) attempted to crack $51,600 resistance throughout Dec. 7 as BTC/USD gained in line with an equities rebound.

Bitcoin: “The trend is still up”

Data from Cointelegraph Markets Pro and TradingView showed the largest cryptocurrency making repeated assaults on the $51,600 mark Tuesday.

At the time of writing, the latest charge was ongoing, as the Wall St. open added further bullish momentum towards $52,000. Bitcoin was up almost 6% overnight.

“Bitcoin rejecting at $51.6K. That’s an important level, just like $53.5-55.5K is,” Cointelegraph contributor Michaël van de Poppe commented earlier.

“The trend still up since the recent crash, through which $49.6K is an area that I’d like to see hold if we want to retest the $53.5-55.5K zone.”

Nerves were still palpable across crypto markets amid broad belief that the current gains could be a so-called “dead cat bounce” and that a return to lower levels awaits.

Nonetheless, the 5% price uptick appeared to do wonders for sentiment in terms of numbers, the Crypto Fear & Greed Index jumping a whole nine points to 25/100 — on the edge of breaking out of “extreme fear.”

“5% does wonders,” fellow trader and analyst TechDev added.

ETF volumes show institutions still hungry for BTC

As Contelegraph reported, appetite for buying Bitcoin has nonetheless remained throughout recent days.

Related: This Bitcoin price metric just hit ‘oversold’ for only the 7th time in 8 years

Along with a conspicuous whale account, institutional interest is also strong, as evidenced by exchange-traded fund (ETF) volumes.

“Yesterday, Purpose Bitcoin ETF had its biggest inflow since the inception,” Lex Moskovski, CIO of Moskovski Capital, summarized looking at the data.

“The demand is here.”

Elsewhere, open interest in Bitcoin futures also ticked up Tuesday, having taken a serious hit as BTC/USD crashed below $42,000.