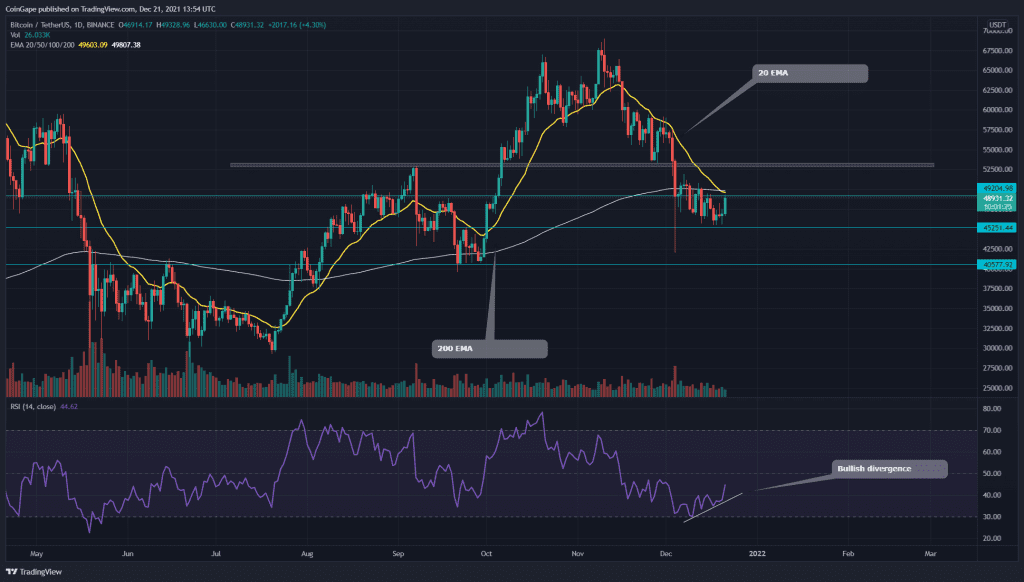

The BTC coin trapped in a correction phase has lost 30% of its value. Moreover, the bears were trying to extend this pullback after taking down 200-day EMA, but couldn’t follow up the breakdown. As for now, a bullish breakout from price pattern and RSI divergence suggests a recovery chance for bitcoin.

Key technical points:

- The BTC coin chart showed a bearish crossover of the 20-and-200 day EMA

- The daily RSI chart shows an evident bullish divergence

- The intraday trading volume in the BTC coin is $29 Billion, indicating a 5.54% loss.

Source- Tradingview

The last time when we covered an article on BTC/USD, the coin price breached the crucial support of 0.5 Fibonacci retracement level and daily 200 EMA. Later the price retraced, trying to identify proper resistance before a significant downfall.

However, even after multiple retests the bears still couldn’t drop the price to a larger extent as the price still managed to sustain above the $45000 psychological level. Moreover, the technical chart shows the price was fluctuating in a falling parallel channel pattern.

The crucial EMA levels(20, 50, 100, and 200), indicating a bearish trend for the coin. Moreover, the pair also shows a bearish crossover between the 20 and 200 EMA.

The Relative Strength Index (44) displays strong bullish divergence in its chart, indicating the growing strength of coin buyers.

BTC/USD 4-hour time frame chart

Source- Tradingview

For more than two weeks, the BTC coin price resonated in a falling parallel channel pattern. However, today the price gave a bullish breakout from this pattern, providing an excellent long opportunity for long traders.

Anyhow, the safe traders can still wait for the price to breach and sustain above the daily 200 EMA line, providing an extra edge in their trading.

The 4-hour traditional pivot shows remarkable confluence with the price action levels. According to these pivot levels, the crypto traders can expect the nearest resistance at $49450 followed by $52200. As for the opposite end, the support levels are $47460 and $44700.