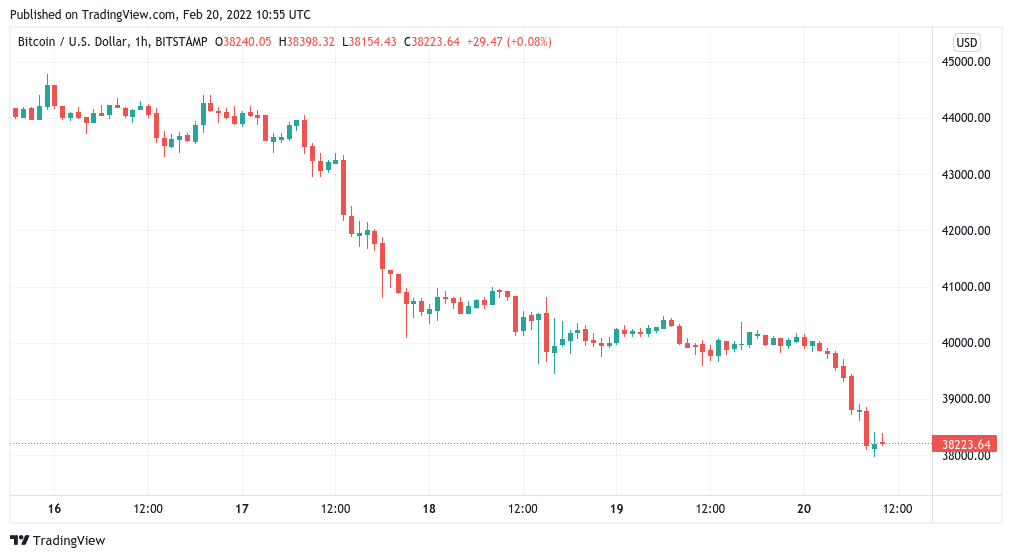

Bitcoin (BTC) saw its first dive below $38,000 in over two weeks on Feb. 20 as macro triggers rattled low-volume weekend markets.

Trader on BTC: “Nothing to get excited about”

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD losing ground Sunday, following threats of fresh sanctions on Russia over its alleged plans to invade neighboring Ukraine.

After a quiet Saturday, crypto began to move downhill after comments from United Kingdom Prime Minister Boris Johnson on financial blocks of Russian firms should the situation escalate.

These would be prohibited from “trading in pounds and dollars,” the BBC reported Johnson as saying Sunday morning, alluding to support from United States President Joe Biden.

With crypto the only markets constantly open, the reaction to geopolitical fears in the region could foreshadow a greater knock-on effect next week as traditional markets open. Monday is a holiday on Wall Street.

Commenting on the situation, Mike McGlone, chief commodity strategist at Bloomberg Intelligence, additionally drew attention to the ongoing issue of inflation and its relationship to risk asset performance.

In line with previous comments, however, he suggested that ultimately, Bitcoin could profit from the sea of change in U.S. economic policy this year.

“Bitcoin indicating a rough week ahead – Inflation Unlikely to Drop Unless Risk Assets Do: Most assets are subject to the ebbing tide in 2022, on the inevitable reversion of the greatest inflation measures in four decades, but this year may mark another milestone for Bitcoin,” he argued.

Among Bitcoin traders, short timeframes were now equally lackluster, with the loss of $40,000 weighing on sentiment.

Now also failing to hold any support. I can see us retesting 40K within the next few days as we’re at support on LTF but generally the HTF isn’t something to get excited about until we retake some important levels.

— Daan Crypto Trades (@DaanCrypto) February 20, 2022

BTC/USD saw lows of $37,974 on Bitstamp Sunday before rebounding to hold above the $38,000 mark.

Extreme fear rises from the dead

Others meanwhile continued to focus on the significance of $40,000 in Bitcoin’s price history.

Related: Bitcoin inactive supply nears record as over 60% of BTC stays unspent for at least 1 year

Since first cracking it in 2021, the level has acted as a springboard for bulls, and for popular Twitter acount Mayne, a recapture should indeed be their first move in order to secure upside.

“Over the last year $40k has been a very critical level for BTC. Each time price broke below and then reclaimed it we’ve seen a large rally to the upside. Probably a good area to watch right now,” it commented Sunday.

In the meantime, however, it appeared that fresh losses were what the masses expected. The Crypto Fear & Greed Index was back in “fear” territory on the day, having seen a drop of over 50% in just four days, after briefly entering “extreme fear.”