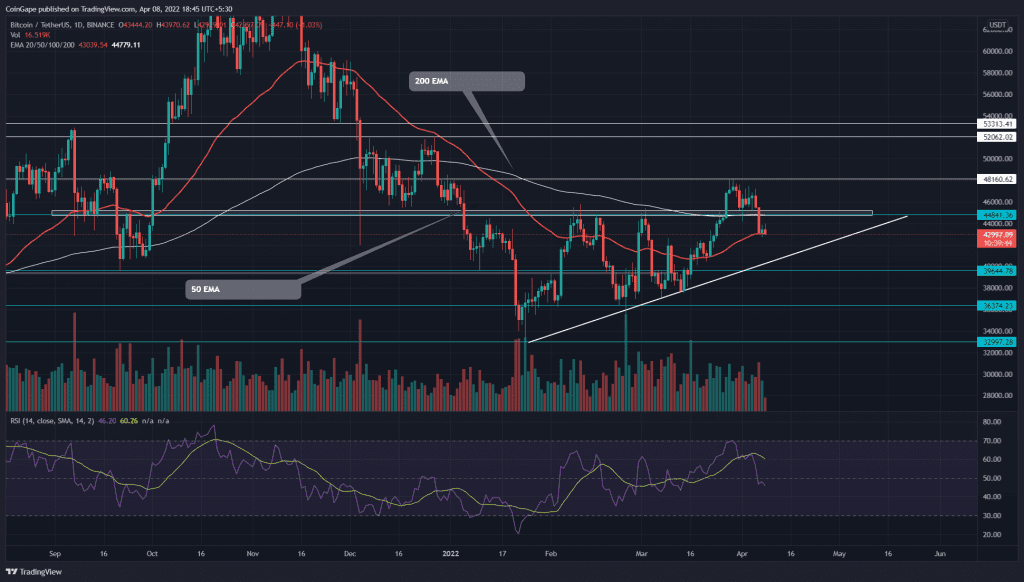

The Bitcoin(BTC) price witnessed high volatility last week, restricting the coin movement between the $48160 and $45000 levels. However, the bear wrestled control from bulls during the consolidation and gave a strong breakdown from the bottom support($45000). Following a retest phase, the BTC price may continue to fall.

Key points:

- The post-retest fall could tumble the BTC price by 9%

- The 50-day EMA acts as a strong support line

- The intraday trading volume in the Bitcoin is $24.2 Billion, indicating a 32.6% lost

Source- Tradingview

Last quarter Bitcoin(BTC) price spent its accumulation phase inside an ascending triangle pattern. The $45000 neckline acted as a crucial resistance that reverted several breakout attempts over the last three months.

However, on March 27th, the coin price gave a decisive breakout from the overhead resistance, suggesting the buyers were ready to rally higher. Furthermore, the BTC price spent more than a week trying to sustain above the $45000 mark, but it couldn’t surpass the $48160 mark.

The sellers took advantage of the market volatility and pulled the coin price below $45000 support on April 6th. Now, the traders can expect a bearish retest for the old $45000 resistance before the altcoin continues to drop lower.

Anyhow, the price pattern’s support trendline remains intact, which could renew the bullish momentum.

- Resistance level- $48150, $5200

- Support level- $36400, $36400

Technical indicator-

Along with $45000 support, the BTC price breached the 20-and-200 EMA. These EMAs lines could assist sellers in restricting the coin price below the breached support.

On March 29th, the RSI slope tagged the overbought neckline at 70%. However, the buyers started to lose momentum right from the consolidation period, and amid the minor correction rally, the indicator dropped below midline(50).