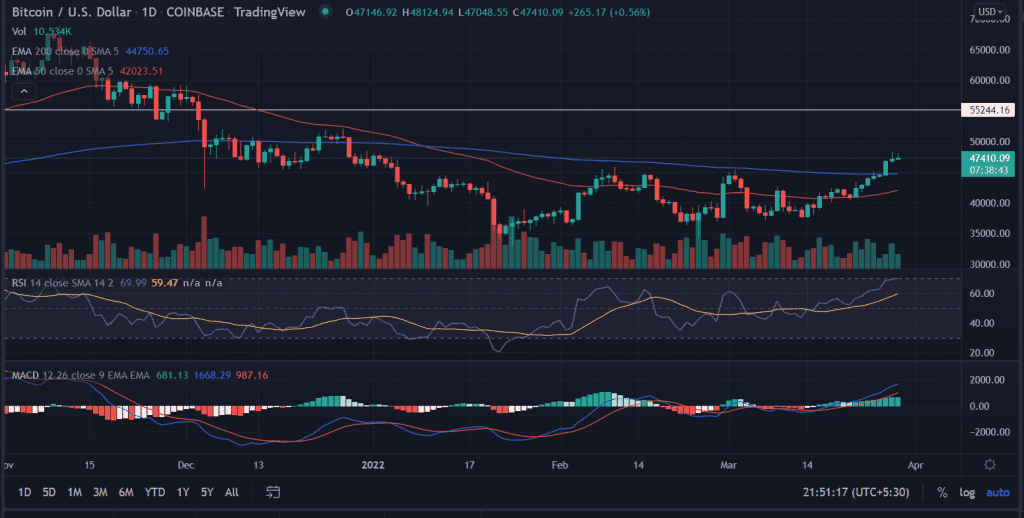

Bitcoin price edges higher on Tuesday. After tagging the session’s higher level the price moves in a very tight range. The formation of two consecutive ‘Doji’ candlesticks questions the continuation of the current price trend.

- Bitcoin price continues to climb but with limited price action.

- A daily close above $48,000 would pave the way for $55,000.

- The momentum oscillators turn neutral warning of aggressive bids.

Bitcoin price consolidates after recent heat up

On the daily chart, the Bitcoin price continues to trade higher but faces some resistance to moving beyond $48,000 on a daily closing basis. The levels were last seen in December. For the first time in the year, 2022 BTC price tagged the coveted level. The mentioned level remains the crucial level to trade.

A decisive close above the $48,000 level will further make the bulls hopeful. In that scenario, investors will not shy away from reaching out to the psychological $50,000 level.

An extended buying pressure will bring $55,000 into play. If that happens then it will be a trend reversal point for the Bitcoin price.

advertisement

On the flip side, if the price falls below the session’s low then it will invalidate the bullish theory at least in the short term. Interim support is placed at the 200-EMA (Exponential Moving Average) at $44,723.

Next, investors would collect the liquidity through the supply zone extending from $42,000 to $40,000.

Bitcoin price surged nearly 50% from the lows of January at $32,933.33 to the 2022 highs of $48,240.

As of writing, BTC/USD is trading at $47,218, up 0.13% for the day. The world’s most famous and largest cryptocurrency is held at $32,615,808,820.

Technical indicators:

RSI: The daily Relative Strength Index trades sideways near 70.

MACD: The Moving Average Convergence Divergence holds above the mid-line but with a neutral bias.